Victoria Harbour, Hong Kong

IFC With Lights "2011"

Tsim Tsa Tsui iSquare 30th Floor View

Central District Mid-Level View

2011 Countdown, TV Broadcast (Cantonese Narration)

Friday, December 31, 2010

Investors Exiting From Treasuries And Bonds Upon Fear Of Inflation

Stock equity market is buoyed at year high with strong support in a thinly traded week. The slightly upward trend begins in October when individual investors rush into equity stock market giving the strong support. Although buying activity is very cautious, there is little selling pressure. At the same time, investors are becoming less interested in treasuries and bonds. Recently, the buying trend is reversed and capital is flowing out of the treasuries and bonds market.

The second round of "Quantitative Easing" ignited the rally in equity stock market. The yield of treasuries did not drop as expected. Instead the rate is steadily rising on inflation speculation due to oversupply of liquidity. Investors exhibit increased risk appetite, encouraged by the wealth effect of asset appreciation.

Institutional investors and hedge funds are inactive during the holiday period. After the New Year holiday, institutional investors will restructure the portfolio in the new year. It is likely that the treasuries and bonds portion in the portfolio will be reduced. With significant amount of cash on hand in a bullish market, the positions in equity stocks and commodities may be strengthened. Hedge funds are much less active in 2010 as compared to 2009 due to uncertainties in economic recovery. However in the coming year, hedge funds will become more active because of the return of individual and household investors in the equity stock market. This will create turbulence and thus opportunity for speculative trading.

The speculative trading portfolio does not perform very well in 2010. Although the majority of trades are long positions, the timing is not quite right. For short term swing trading, it may result in a loss despite the fact that many of the traded stocks have significantly higher price at the end of the year. Therefore the speculative tradings are not executed with appropriate skills and strategy. This experience will be useful to improve the speculative trading strategy. As discussed in earlier post, it would be advantageous to estimate with accuracy the short term cycle in stock price movement from market participants activities.

The outlook for the coming year is to continue current bullish trend in the first quarter as broad base of investors are chasing assets with surplus capital liquidity. However, it is not without worry because the concentration of wealth may post a threat to the stability of society at large. Equity stock market may perform much better than the economy which on the other hand affects the living standard of the general public. Inflation is another threat as well.

"Stocks down slightly as investors lock in 2010" Stocks are set to end 2010 on an upbeat note: The S&P 500 index and the Dow Jones industrial average are both up 14 percent for the year, after dividends, thanks to record corporate profits. The Dow is back to levels last seen in August 2008, prior to the heat of the financial crisis, while the S&P might just eke out the best December in 20 years.

"Outlook 2011: Daniel Gross Puts on His Prediction Cap" You might be relieved to hear that he remains bullish on America and that he does not foresee the sovereign debt crisis reaching our shores, at least not this time around.

The second round of "Quantitative Easing" ignited the rally in equity stock market. The yield of treasuries did not drop as expected. Instead the rate is steadily rising on inflation speculation due to oversupply of liquidity. Investors exhibit increased risk appetite, encouraged by the wealth effect of asset appreciation.

Institutional investors and hedge funds are inactive during the holiday period. After the New Year holiday, institutional investors will restructure the portfolio in the new year. It is likely that the treasuries and bonds portion in the portfolio will be reduced. With significant amount of cash on hand in a bullish market, the positions in equity stocks and commodities may be strengthened. Hedge funds are much less active in 2010 as compared to 2009 due to uncertainties in economic recovery. However in the coming year, hedge funds will become more active because of the return of individual and household investors in the equity stock market. This will create turbulence and thus opportunity for speculative trading.

The speculative trading portfolio does not perform very well in 2010. Although the majority of trades are long positions, the timing is not quite right. For short term swing trading, it may result in a loss despite the fact that many of the traded stocks have significantly higher price at the end of the year. Therefore the speculative tradings are not executed with appropriate skills and strategy. This experience will be useful to improve the speculative trading strategy. As discussed in earlier post, it would be advantageous to estimate with accuracy the short term cycle in stock price movement from market participants activities.

The outlook for the coming year is to continue current bullish trend in the first quarter as broad base of investors are chasing assets with surplus capital liquidity. However, it is not without worry because the concentration of wealth may post a threat to the stability of society at large. Equity stock market may perform much better than the economy which on the other hand affects the living standard of the general public. Inflation is another threat as well.

"Stocks down slightly as investors lock in 2010" Stocks are set to end 2010 on an upbeat note: The S&P 500 index and the Dow Jones industrial average are both up 14 percent for the year, after dividends, thanks to record corporate profits. The Dow is back to levels last seen in August 2008, prior to the heat of the financial crisis, while the S&P might just eke out the best December in 20 years.

"Outlook 2011: Daniel Gross Puts on His Prediction Cap" You might be relieved to hear that he remains bullish on America and that he does not foresee the sovereign debt crisis reaching our shores, at least not this time around.

Last Kodachrome Developer Stops Developing

The Huffington Post

Kodachrome film is truly dead.

Dwayne's Photo, a lab in Parsons, Kansas, was the last lab still processing popular film, which was created by Kodak in 1935. Dec. 30 was the last day Dwayne's would still accept rolls of the film for processing, according to Mashable.

Kodak announced they would cease production of the film in June 2009, as sales had declined. The rise in digital camera use among everyday people and professionals contributed to its decline.

At one point, 25 labs in the world processed the near extinct film, according to the New York Times. The Kodak-run facility closed a few years ago, and since then processing facilities in Japan, Switzerland, and other locations around the globe have since stopped developing Kodachrome.

Despite its use in many iconic photographs, including Steve McCurry's National Geographic 1985 cover image, many photographers have traded in for newer films or digital cameras. According to Mashable, Kodak actually gave McCurry the last roll of Kodachrome film last year, and he has since posted the pictures he took to his blog.

Dwayne's Photo is Not Closing.

We will continue to process other types of film and provide all of our other services. Only Kodachrome processing is being discontinued.

The Last Roll of Kodachrome.

On December 30th we will process the last roll of Kodachrome slide film.

To commemorate the best slide and movie film ever made, show off the Kodachrome colors with this 100% cotton T-shirt. Only $12.95 Hurry, limited supply.

Kodachrome film is truly dead.

Dwayne's Photo, a lab in Parsons, Kansas, was the last lab still processing popular film, which was created by Kodak in 1935. Dec. 30 was the last day Dwayne's would still accept rolls of the film for processing, according to Mashable.

Kodak announced they would cease production of the film in June 2009, as sales had declined. The rise in digital camera use among everyday people and professionals contributed to its decline.

At one point, 25 labs in the world processed the near extinct film, according to the New York Times. The Kodak-run facility closed a few years ago, and since then processing facilities in Japan, Switzerland, and other locations around the globe have since stopped developing Kodachrome.

Despite its use in many iconic photographs, including Steve McCurry's National Geographic 1985 cover image, many photographers have traded in for newer films or digital cameras. According to Mashable, Kodak actually gave McCurry the last roll of Kodachrome film last year, and he has since posted the pictures he took to his blog.

Dwayne's Photo

Kodachrome Processing is Ending.

Push/Pull processing of Kodachrome film will be discontinued on December 21, 2010. Any rolls requesting Push/Pull processing after this date will be processed as normal with no adjustments.

The last day of processing for all types of Kodachrome film will be December 30th, 2010. The last day Kodak will accept prepaid 35mm Kodachrome film in Europe is November 30th, 2010. Film that is not in our lab by noon on December 30th will not be processed.

Dwayne's Photo is Not Closing.

We will continue to process other types of film and provide all of our other services. Only Kodachrome processing is being discontinued.

The Last Roll of Kodachrome.

On December 30th we will process the last roll of Kodachrome slide film.

To commemorate the best slide and movie film ever made, show off the Kodachrome colors with this 100% cotton T-shirt. Only $12.95 Hurry, limited supply.

Thursday, December 30, 2010

UNIVAC II Main Console (Working!)

In the Philadelphia area at UNISYS Tredyffrin Executive Briefing Center front lobby, there is a working UNIVAC II main console, with Winky Blinky lights and all:

The UNIVAC 1 is a machine with important historical significance to the computer industry because it was the first mass-produced computer to be sold to corporations. It's also the computer that has the distinction of being the one that Walter Cronkite used to correctly predict the outcome of the 1952 Presidential Election.

UNIVAC later on was purchased by Sperry (just following its purchase of Remington Rand) which later on merged with Burroughs and became UNISYS in 1986. The console depicted above in the lobby of UNISYS Tredy is actually a UNIVAC II, an improved version of the original utilizing transistorized components that was released in 1958, a few years after the Sperry merger.

The UNIVAC 1 is a machine with important historical significance to the computer industry because it was the first mass-produced computer to be sold to corporations. It's also the computer that has the distinction of being the one that Walter Cronkite used to correctly predict the outcome of the 1952 Presidential Election.

UNIVAC later on was purchased by Sperry (just following its purchase of Remington Rand) which later on merged with Burroughs and became UNISYS in 1986. The console depicted above in the lobby of UNISYS Tredy is actually a UNIVAC II, an improved version of the original utilizing transistorized components that was released in 1958, a few years after the Sperry merger.

Wednesday, December 29, 2010

【黃子華棟篤笑 - 越大鑊越快樂】

【黃子華棟篤笑 - 越大鑊越快樂】Part 1 of 12

【黃子華棟篤笑 - 越大鑊越快樂】Part 2 of 12

【黃子華棟篤笑 - 越大鑊越快樂】Part 3 of 12

【黃子華棟篤笑 - 越大鑊越快樂】Part 4 of 12

【黃子華棟篤笑 - 越大鑊越快樂】Part 5 of 12

【黃子華棟篤笑 - 越大鑊越快樂】Part 6 of 12

【黃子華棟篤笑 - 越大鑊越快樂】Part 7 of 12

【黃子華棟篤笑 - 越大鑊越快樂】Part 8 of 12

【黃子華棟篤笑 - 越大鑊越快樂】Part 9 of 12

【黃子華棟篤笑 - 越大鑊越快樂】Part 10 of 12

【黃子華棟篤笑 - 越大鑊越快樂】Part 11 of 12

【黃子華棟篤笑 - 越大鑊越快樂】Part 12 of 12

【黃子華棟篤笑 - 越大鑊越快樂】Part 2 of 12

【黃子華棟篤笑 - 越大鑊越快樂】Part 3 of 12

【黃子華棟篤笑 - 越大鑊越快樂】Part 4 of 12

【黃子華棟篤笑 - 越大鑊越快樂】Part 5 of 12

【黃子華棟篤笑 - 越大鑊越快樂】Part 6 of 12

【黃子華棟篤笑 - 越大鑊越快樂】Part 7 of 12

【黃子華棟篤笑 - 越大鑊越快樂】Part 8 of 12

【黃子華棟篤笑 - 越大鑊越快樂】Part 9 of 12

【黃子華棟篤笑 - 越大鑊越快樂】Part 10 of 12

【黃子華棟篤笑 - 越大鑊越快樂】Part 11 of 12

【黃子華棟篤笑 - 越大鑊越快樂】Part 12 of 12

【黃子華棟篤笑2006 - 兒童不宜】

【黃子華棟篤笑2006 - 兒童不宜】Part 1 of 12

【黃子華棟篤笑2006 - 兒童不宜】Part 2 of 12

【黃子華棟篤笑2006 - 兒童不宜】Part 3 of 12

【黃子華棟篤笑2006 - 兒童不宜】Part 4 of 12

【黃子華棟篤笑2006 - 兒童不宜】Part 5 of 12

【黃子華棟篤笑2006 - 兒童不宜】Part 6 of 12

【黃子華棟篤笑2006 - 兒童不宜】Part 7 of 12

【黃子華棟篤笑2006 - 兒童不宜】Part 8 of 12

【黃子華棟篤笑2006 - 兒童不宜】Part 9 of 12

【黃子華棟篤笑2006 - 兒童不宜】Part 10 of 12

【黃子華棟篤笑2006 - 兒童不宜】Part 11 of 12

【黃子華棟篤笑2006 - 兒童不宜】Part 12 of 12

【黃子華棟篤笑2006 - 兒童不宜】Part 2 of 12

【黃子華棟篤笑2006 - 兒童不宜】Part 3 of 12

【黃子華棟篤笑2006 - 兒童不宜】Part 4 of 12

【黃子華棟篤笑2006 - 兒童不宜】Part 5 of 12

【黃子華棟篤笑2006 - 兒童不宜】Part 6 of 12

【黃子華棟篤笑2006 - 兒童不宜】Part 7 of 12

【黃子華棟篤笑2006 - 兒童不宜】Part 8 of 12

【黃子華棟篤笑2006 - 兒童不宜】Part 9 of 12

【黃子華棟篤笑2006 - 兒童不宜】Part 10 of 12

【黃子華棟篤笑2006 - 兒童不宜】Part 11 of 12

【黃子華棟篤笑2006 - 兒童不宜】Part 12 of 12

【黃子華棟篤笑2010 -譁眾取寵】

【黃子華棟篤笑2010 -譁眾取寵】Part 1 pf 9

【黃子華棟篤笑2010 -譁眾取寵】Part 2 pf 9

【黃子華棟篤笑2010 -譁眾取寵】Part 3 pf 9

【黃子華棟篤笑2010 -譁眾取寵】Part 4 pf 9

【黃子華棟篤笑2010 -譁眾取寵】Part 5 pf 9

【黃子華棟篤笑2010 -譁眾取寵】Part 6 pf 9

【黃子華棟篤笑2010 -譁眾取寵】Part 7 pf 9

【黃子華棟篤笑2010 -譁眾取寵】Part 8 pf 9

【黃子華棟篤笑2010 -譁眾取寵】Part 9 pf 9

【黃子華棟篤笑2010 -譁眾取寵】Part 2 pf 9

【黃子華棟篤笑2010 -譁眾取寵】Part 3 pf 9

【黃子華棟篤笑2010 -譁眾取寵】Part 4 pf 9

【黃子華棟篤笑2010 -譁眾取寵】Part 5 pf 9

【黃子華棟篤笑2010 -譁眾取寵】Part 6 pf 9

【黃子華棟篤笑2010 -譁眾取寵】Part 7 pf 9

【黃子華棟篤笑2010 -譁眾取寵】Part 8 pf 9

【黃子華棟篤笑2010 -譁眾取寵】Part 9 pf 9

Tuesday, December 28, 2010

【食神】周星馳 莫文蔚 (The God of Cookery)

The God of Cookery

Actor: Stephen Chow, Karen Mok

Director: Lee Lik Chee

Run Time: 96 minutes

Distributor: Universe Laser

Synopsis: An arrogant, shallow chef hits the skids when his cooking empire is usurped by a men-spirited rival. He is saved by the true love and good cooking of Sister Turkey, a plain but pure-hearted street vendor whose wares heal the sick. Together, the two conspire to regain power by besting their foes in an winner-take-all cook-off.

【食神】Part 1 of 11

【食神】Part 2 of 11

【食神】Part 3 of 11

【食神】Part 4 of 11

【食神】Part 5 of 11

【食神】Part 6 of 11

【食神】Part 7 of 11

【食神】Part 8 of 11

【食神】Part 9 of 11

【食神】Part 10 of 11

【食神】Part 11 of 11

Actor: Stephen Chow, Karen Mok

Director: Lee Lik Chee

Run Time: 96 minutes

Distributor: Universe Laser

Synopsis: An arrogant, shallow chef hits the skids when his cooking empire is usurped by a men-spirited rival. He is saved by the true love and good cooking of Sister Turkey, a plain but pure-hearted street vendor whose wares heal the sick. Together, the two conspire to regain power by besting their foes in an winner-take-all cook-off.

【食神】Part 1 of 11

【食神】Part 2 of 11

【食神】Part 3 of 11

【食神】Part 4 of 11

【食神】Part 5 of 11

【食神】Part 6 of 11

【食神】Part 7 of 11

【食神】Part 8 of 11

【食神】Part 9 of 11

【食神】Part 10 of 11

【食神】Part 11 of 11

【武狀元蘇乞兒】周星馳 張敏 (King of Beggars)

King of Beggars

Actor: Stephen Chow, Shara Cheung

Director: Gordon Chan

Run Time: 101 minutes

Distributor: Mei Ah Entertainment

Synopsis: The illiterate General of Canton, General So, advocates a lazy, happy lifestyle of sex and money. His spoiled and also illiterate son, Chan (Stephen Chow), is his most faithful disciple. For the love of a woman, Chan attends the national exams for Martial Arts Scholar in Peking. Chan is victorious on the physical test, but before he is to be crowned, he is found to have cheated on the written exam. The Emperor sentences Chan to be a beggar. Initially Chan is unable cope with his new role, but with some mystic help, he takes on the position as King of the Beggars Association. Leading this motley crew into battle against an evil warlord in the Emperor's entourage, Chan rescues the Emperor, and gains respect for the beggars.

【武狀元蘇乞兒】Part 1 of 12

【武狀元蘇乞兒】Part 2 of 12

【武狀元蘇乞兒】Part 3 of 12

【武狀元蘇乞兒】Part 4 of 12

【武狀元蘇乞兒】Part 5 of 12

【武狀元蘇乞兒】Part 6 of 12

【武狀元蘇乞兒】Part 7 of 12

【武狀元蘇乞兒】Part 8 of 12

【武狀元蘇乞兒】Part 9 of 12

【武狀元蘇乞兒】Part 10 of 12

【武狀元蘇乞兒】Part 11 of 12

【武狀元蘇乞兒】Part 12 of 12

Actor: Stephen Chow, Shara Cheung

Director: Gordon Chan

Run Time: 101 minutes

Distributor: Mei Ah Entertainment

Synopsis: The illiterate General of Canton, General So, advocates a lazy, happy lifestyle of sex and money. His spoiled and also illiterate son, Chan (Stephen Chow), is his most faithful disciple. For the love of a woman, Chan attends the national exams for Martial Arts Scholar in Peking. Chan is victorious on the physical test, but before he is to be crowned, he is found to have cheated on the written exam. The Emperor sentences Chan to be a beggar. Initially Chan is unable cope with his new role, but with some mystic help, he takes on the position as King of the Beggars Association. Leading this motley crew into battle against an evil warlord in the Emperor's entourage, Chan rescues the Emperor, and gains respect for the beggars.

【武狀元蘇乞兒】Part 1 of 12

【武狀元蘇乞兒】Part 2 of 12

【武狀元蘇乞兒】Part 3 of 12

【武狀元蘇乞兒】Part 4 of 12

【武狀元蘇乞兒】Part 5 of 12

【武狀元蘇乞兒】Part 6 of 12

【武狀元蘇乞兒】Part 7 of 12

【武狀元蘇乞兒】Part 8 of 12

【武狀元蘇乞兒】Part 9 of 12

【武狀元蘇乞兒】Part 10 of 12

【武狀元蘇乞兒】Part 11 of 12

【武狀元蘇乞兒】Part 12 of 12

The King of Stamps in China

From WSJ.com

Auctioneers Zurich Asia have put an estimate of HK$2.5 million to HK$3 million on the extremely rare Chinese one dollar stamp, from 1897 — only 33 to 34 are known to exist today.

By contrast, the sheet of 80 Red Monkey stamps is far less rare and less ancient, but the stamps are very popular. “It is the most popular stamp in China,” says Louis Mangin, the director Zurich Asia. “This is the king of stamps in China.”

Five million Red Monkey stamps are in circulation. Its popularity stems from its appearance — black monkeys on an auspicious red background — and because they were issued in 1980, the year of the Golden Monkey, a lucky year in the Chinese zodiac that comes around only once every 60 years.

Mr. Mangin has little doubt that the Red Monkey stamps will sell to a mainland Chinese buyer for an estimated 1 million Hong Kong dollars a sheet. In recent years, stamp collecting has become more popular in China, in step with the country’s growing wealth. “They’re purchasing power is greater. They became wealthy so fast, they can afford it,” he says.

Collectors in China tend to focus on modern stamps that are popular like the Red Monkey, or extremely rare Chinese stamps.

Synthetic Life (from synthetic DNA transplant)

Craig Venter: On the verge of creating synthetic life

Craig Venter & Synthetic Life Debate - BBC Newsnight & BBC America Reports

Artificial Life Created

Craig Venter & Synthetic Life Debate - BBC Newsnight & BBC America Reports

Artificial Life Created

Monday, December 27, 2010

Rubik's Cube Records

Rubik's Cube record is set on November 13th at the Melbourne Cube Day 2010.

Rubik's Cube Blindfolded: Former World Record 3/11/2006

Rubik's Cube Blindfolded: 47.31 seconds

Rubik's Cube Blindfolded : 45.55 seconds (Haiyan Zhuang, Hong Kong Open 2009 - July 19th)

Rubik's Cube Blindfolded : 30.94 seconds

Rubik's Cube One-handed: 14.56 seconds World Record Yu Nakajima

2 Rubik's Cubes: 41.47 seconds

Rubik's Cube Blindfolded: Former World Record 3/11/2006

Rubik's Cube Blindfolded: 47.31 seconds

Rubik's Cube Blindfolded : 45.55 seconds (Haiyan Zhuang, Hong Kong Open 2009 - July 19th)

Rubik's Cube Blindfolded : 30.94 seconds

Rubik's Cube One-handed: 14.56 seconds World Record Yu Nakajima

2 Rubik's Cubes: 41.47 seconds

Thursday, December 23, 2010

【讓子彈飛】周潤發 姜文 葛优

【讓子彈飛】Part 1 of 9

【讓子彈飛】Part 2 of 9

【讓子彈飛】Part 3 of 9

【讓子彈飛】Part 4 of 9

【讓子彈飛】Part 5 of 9

【讓子彈飛】Part 6 of 9

【讓子彈飛】Part 7 of 9

【讓子彈飛】Part 8 of 9

【讓子彈飛】Part 9 of 9

【讓子彈飛】Part 2 of 9

【讓子彈飛】Part 3 of 9

【讓子彈飛】Part 4 of 9

【讓子彈飛】Part 5 of 9

【讓子彈飛】Part 6 of 9

【讓子彈飛】Part 7 of 9

【讓子彈飛】Part 8 of 9

【讓子彈飛】Part 9 of 9

Paradigm Shift of Equity Stock Buying

Investors are supporting equity stock market with risk appetite. However, the buying pattern is different from the beginning of the year. During the period from February to May, individual investors are waiting on the sideline with cash in the safety of money market. Institutional investors are slowly buying up the market unanimously. The stock market chart shows a uniform upward trend during that period until the flash crash in May. Now at the end of the year, institutional investors have realised some of the profit and sit on both equity stock as well as cash and reward themselves with year end bonus. Individual investors watch themselves missing the 2009 rally and the growth of wealth of equity stock shareholders. Feeling the wealth creation effect, they finally start to re-enter the market in October.

Unlike institutional investors early in the year, individual investors are extremely cautious in buying. As a result, market moves in an upward trend but with bumps, supported by strong desire of buying and minimal selling pressure. It appears that individual investors have not stopped buying yet. With less sellers than buyers, broad market index is constantly making record high of the year. Mutual fund managers have secured this year's bonus and seek relief from portfolio performance pressure. Hedge fund managers are planning for the next move and is watching the market for opportunity. The herd of individual investors are busy looking for stocks to buy as well as to take profit to avoid potential dip in market. Thus there is increased day trading activities.

The buying driven rally may last longer until beginning of earning season or another event such as the flash crash. The wealth effect as well as fear of inflation helps to increase the risk appetite of investors, shifting portion of the portfolio from treasuries and bonds to commodities and equity stocks. Market participants are creating a regenerative cycle of wealth creation, in other words bubble. Although economic growth is less than the rate to support current fast pace of wealth creation, the regenerative nature of asset appreciation can sustain until market calms down, or economic growth catches up, or overly priced.

Equity stock is gaining strong support from optimistic market participants despite moderate economic outlook. Short term market performance may not correlate directly to longer term economic condition.

"Investors enter 2011 in bullish mood: Reuters poll" Investors are entering 2011 in a relatively bullish mood, raising equity holdings to a 10-month high, increasing exposure to high-yield credit and cutting back on government debt, Reuters polls showed on Wednesday.

A combination of improving economic data and a belief in future, robust, corporate earnings has lifted investor appetite for equities over the past few months.

"People are coming off the sidelines and buying stocks," said Keith Wirtz, president and chief investment officer at Fifth Third Asset Management in Cincinnati.

There was also sign of risk appetite in an increased exposure to riskier, higher yield bonds.

"Does a Low VIX Signal Danger?" Remember all the way back to April 2010? Spring was in the air, the Mets were still mathematically alive in the National League East race, and the VIX (the Chicago Board Options Exchange volatility index) was near 15. The singing birds obscured the approaching clouds, and before you knew it we had Flash-Crashed our way into a Fear blitz.

Unlike institutional investors early in the year, individual investors are extremely cautious in buying. As a result, market moves in an upward trend but with bumps, supported by strong desire of buying and minimal selling pressure. It appears that individual investors have not stopped buying yet. With less sellers than buyers, broad market index is constantly making record high of the year. Mutual fund managers have secured this year's bonus and seek relief from portfolio performance pressure. Hedge fund managers are planning for the next move and is watching the market for opportunity. The herd of individual investors are busy looking for stocks to buy as well as to take profit to avoid potential dip in market. Thus there is increased day trading activities.

The buying driven rally may last longer until beginning of earning season or another event such as the flash crash. The wealth effect as well as fear of inflation helps to increase the risk appetite of investors, shifting portion of the portfolio from treasuries and bonds to commodities and equity stocks. Market participants are creating a regenerative cycle of wealth creation, in other words bubble. Although economic growth is less than the rate to support current fast pace of wealth creation, the regenerative nature of asset appreciation can sustain until market calms down, or economic growth catches up, or overly priced.

Equity stock is gaining strong support from optimistic market participants despite moderate economic outlook. Short term market performance may not correlate directly to longer term economic condition.

"Investors enter 2011 in bullish mood: Reuters poll" Investors are entering 2011 in a relatively bullish mood, raising equity holdings to a 10-month high, increasing exposure to high-yield credit and cutting back on government debt, Reuters polls showed on Wednesday.

A combination of improving economic data and a belief in future, robust, corporate earnings has lifted investor appetite for equities over the past few months.

"People are coming off the sidelines and buying stocks," said Keith Wirtz, president and chief investment officer at Fifth Third Asset Management in Cincinnati.

There was also sign of risk appetite in an increased exposure to riskier, higher yield bonds.

"Does a Low VIX Signal Danger?" Remember all the way back to April 2010? Spring was in the air, the Mets were still mathematically alive in the National League East race, and the VIX (the Chicago Board Options Exchange volatility index) was near 15. The singing birds obscured the approaching clouds, and before you knew it we had Flash-Crashed our way into a Fear blitz.

【孤男寡女】劉德華 鄭秀文 (Hong Kong Movie)

Music Video (Performed by 鄭秀文 Sammi Cheng)

孤男寡女 Part 1

孤男寡女 Part 2

孤男寡女 Part 3

孤男寡女 Part 4

孤男寡女 Part 5

孤男寡女 Part 6

孤男寡女 Part 7

孤男寡女 Part 8

孤男寡女 Part 9

孤男寡女 Part 10

孤男寡女 Part 11

孤男寡女 Part 1

孤男寡女 Part 2

孤男寡女 Part 3

孤男寡女 Part 4

孤男寡女 Part 5

孤男寡女 Part 6

孤男寡女 Part 7

孤男寡女 Part 8

孤男寡女 Part 9

孤男寡女 Part 10

孤男寡女 Part 11

Tuesday, December 21, 2010

YouTube Movie 【讓子彈飛】周潤發 姜文

Following video clips are not uploaded video content in this blog. The video content source is hosted in YouTube uploaded by a third party.

【讓子彈飛】 Part 1 of 9

【讓子彈飛】 Part 2 of 9

【讓子彈飛】 Part 3 of 9

【讓子彈飛】 Part 4 of 9

【讓子彈飛】 Part 5 of 9

【讓子彈飛】 Part 6 of 9

【讓子彈飛】 Part 7 of 9

【讓子彈飛】 Part 8 of 9

【讓子彈飛】 Part 9 of 9

【讓子彈飛】 Part 1 of 9

【讓子彈飛】 Part 2 of 9

【讓子彈飛】 Part 3 of 9

【讓子彈飛】 Part 4 of 9

【讓子彈飛】 Part 5 of 9

【讓子彈飛】 Part 6 of 9

【讓子彈飛】 Part 7 of 9

【讓子彈飛】 Part 8 of 9

【讓子彈飛】 Part 9 of 9

Friday, December 17, 2010

Power Of Liquidity - Enormous Wealth Creation In Weak Economic Recovery

Equity stock market is buoyed at year high with little selling pressure from profit taking. Capital liquidity from Federal Reserve quantitative easing effort boosts asset prices with the exception of real estate. However, the most benefited are the already rich people. The majority of household wealth is tied in the homes. A smaller portion is in investment such as equity stocks and bonds. Some household may flee to the safety of money market after the financial crisis.

Institutional investors sit with equity stocks and cash holdings, watching hedge funds and individual investors perform the year end window dressing. At current level, hedge funds are preparing for the next movement direction in the equity stock market. It may be up or down depending on which side can attract more followers. It appears that market participants are holding up with stock positions. This may be result of switching from treasuries and bonds to equity stocks.

There is increased activity in stock market day trading. Although individual investors re-enter the market recently from the temptation of asset appreciation, they are very cautious on the experience of the financial crisis. While the core investment is held for long term appreciation, the liquid portion of portfolio is allocated for short term profit on market tidal wave.

"Welcome Back, Bull Market". Forget that stocks have walked up and down the unchanged line in the past week like prisoners on a chain gang. The fact is that the smell of greed is in the air, raising the curtain on a new year likely to brim with excess and more excess. In summary, if the latest signs of an economic spring are right, it is time to prepare to be swept off your feet. Still, be sure the brakes are close at hand — just don't squeeze too tight.

"As Bears Retreat, 'Goldilocks' Comes Out of Hiding". On Tuesday, the Fed admitted "progress toward its objectives has been disappointingly slow," which is why they'll keep rates at zero and continue 'QE' for the foreseeable future.

Institutional investors sit with equity stocks and cash holdings, watching hedge funds and individual investors perform the year end window dressing. At current level, hedge funds are preparing for the next movement direction in the equity stock market. It may be up or down depending on which side can attract more followers. It appears that market participants are holding up with stock positions. This may be result of switching from treasuries and bonds to equity stocks.

There is increased activity in stock market day trading. Although individual investors re-enter the market recently from the temptation of asset appreciation, they are very cautious on the experience of the financial crisis. While the core investment is held for long term appreciation, the liquid portion of portfolio is allocated for short term profit on market tidal wave.

"Welcome Back, Bull Market". Forget that stocks have walked up and down the unchanged line in the past week like prisoners on a chain gang. The fact is that the smell of greed is in the air, raising the curtain on a new year likely to brim with excess and more excess. In summary, if the latest signs of an economic spring are right, it is time to prepare to be swept off your feet. Still, be sure the brakes are close at hand — just don't squeeze too tight.

"As Bears Retreat, 'Goldilocks' Comes Out of Hiding". On Tuesday, the Fed admitted "progress toward its objectives has been disappointingly slow," which is why they'll keep rates at zero and continue 'QE' for the foreseeable future.

Friday, December 10, 2010

Concentration of Wealth May Cause Instability in Society As Well As Stock

Broad market index is buoyed at year high with relatively light volume trading compared to previous week. Investors are holding stocks in the portfolio for future appreciation. Lack of selling pressure help to keep stocks on a rising trend. Hedge funds continue to attempt to push equity stock higher on buying interest from individual investors. However, individual investors become more cautious as the market advances further. Wealth creation effect encourages them to enter the equity stock market after staying on the sideline for extended time. However they are closely watching the new wealth from equity stocks and is ready to guard their wealth against market turbulence. On the other hand, hedge funds are manipulating the market with liquidity from capital market. There remains probability that hedge funds will start to sell down the market when it has climbed to certain level and unfavorable news come out of market. Institutional investors remain neutral with combination of cash and equity stocks in the portfolio. The gradual advance of market help to maintain a bullish outlook from diverse investors. It is uncertain whether the economic growth is strong enough to attract support from all market participants for a continuous climb of the market.

The 2008 financial crisis triggered the recession. It also created an opportunity of wealth transfer leading to the concentration of wealth in current society.

"BERNANKE: Inequality and Tax "Loopholes" Are a Big Problem For America" Inequality is the result of an economy that favors the financially savvy and the globalization trend that has decimated our manufacturing sector.

"David Stockman: Lack of Middle Class Jobs + Low Growth = "Alleged Recovery"" Stockman believes severe structural problems in the job market will continue to haunt the U.S. economy. Most of the job gains come from temporary or entry level jobs, he says. But, without rejuvenation in the "base of the economy...where the high paying jobs exist" the economy will continue to struggle with "very, very slow growth." "We've got a real income distribution problem in this economy," argues Stockman, "and it's getting worse, not better."

"Obama-GOP Agree to Tax Breaks But "We Need Major Tax INCREASES," David Stockman Says" "Nothing will happen on the deficit" unless and until there's "major upheaval" in the bond market. Treasuries rallied Monday following Ben Bernanke's appearance on 60 Minutes but the bond market is likely to suffer a "firestorm of selling" sooner rather than later, Stockman predicts.

Although equity stock market advances in the past two weeks, it does not jump on massive buying from investors. Institutional investors become less aggressive in buying as earlier in the year. Individual investors take the place to drive the stock market lately. Hedge funds switch portion of the portfolio from treasuries and bonds to equity stocks and create turbulence in the market. Short term outlook on market is volatile.

"Buy? Sell? Hold? Investing Moves to Make Now" As the year winds down, investors confront a number of confusing trends, making it harder to figure out if it's a time to buy or sell. One example of how bewildering it's become: The Federal Reserve has launched a historic program to buy bonds, a step termed "quantitative easing," aimed at pushing down bond yields and mortgage rates and other consumer interest rates. But long-term bond yields and mortgage rates have climbed, not fallen, since the program was unveiled just over a month ago, underscoring how mystifying the current investment environment is.

"What Happened to the Rally? Why Markets Are So Worried" The level of uncertainty is threatening a rally across markets, even at a time when many economists are raising their growth forecasts for 2011. "Momentum is clearly subsiding despite the rampant positive sentiment, and negative divergences are highly evident," David Rosenberg, economist and strategist at Gluskin Sheff in Toronto wrote in his daily analysis. "Just as the economics community was doing radical surgery right at the July-August lows in the market, it is now raising its growth projections right at the highs. That is a contrary warning shot."

"Companies Cling to Cash" Corporate America's cash pile has hit its highest level in half a century. The cash buildup shows the deep caution many companies feel about investing in expansion while the economic recovery remains painfully slow and high unemployment and battered household finances continue to limit consumers' ability to spend. "The corporate sector is looking at the household sector and saying, this is not the environment where we should expand our business," said Deutsche Bank economist Torsten Slok.

The 2008 financial crisis triggered the recession. It also created an opportunity of wealth transfer leading to the concentration of wealth in current society.

"BERNANKE: Inequality and Tax "Loopholes" Are a Big Problem For America" Inequality is the result of an economy that favors the financially savvy and the globalization trend that has decimated our manufacturing sector.

"David Stockman: Lack of Middle Class Jobs + Low Growth = "Alleged Recovery"" Stockman believes severe structural problems in the job market will continue to haunt the U.S. economy. Most of the job gains come from temporary or entry level jobs, he says. But, without rejuvenation in the "base of the economy...where the high paying jobs exist" the economy will continue to struggle with "very, very slow growth." "We've got a real income distribution problem in this economy," argues Stockman, "and it's getting worse, not better."

"Obama-GOP Agree to Tax Breaks But "We Need Major Tax INCREASES," David Stockman Says" "Nothing will happen on the deficit" unless and until there's "major upheaval" in the bond market. Treasuries rallied Monday following Ben Bernanke's appearance on 60 Minutes but the bond market is likely to suffer a "firestorm of selling" sooner rather than later, Stockman predicts.

Although equity stock market advances in the past two weeks, it does not jump on massive buying from investors. Institutional investors become less aggressive in buying as earlier in the year. Individual investors take the place to drive the stock market lately. Hedge funds switch portion of the portfolio from treasuries and bonds to equity stocks and create turbulence in the market. Short term outlook on market is volatile.

"Buy? Sell? Hold? Investing Moves to Make Now" As the year winds down, investors confront a number of confusing trends, making it harder to figure out if it's a time to buy or sell. One example of how bewildering it's become: The Federal Reserve has launched a historic program to buy bonds, a step termed "quantitative easing," aimed at pushing down bond yields and mortgage rates and other consumer interest rates. But long-term bond yields and mortgage rates have climbed, not fallen, since the program was unveiled just over a month ago, underscoring how mystifying the current investment environment is.

"What Happened to the Rally? Why Markets Are So Worried" The level of uncertainty is threatening a rally across markets, even at a time when many economists are raising their growth forecasts for 2011. "Momentum is clearly subsiding despite the rampant positive sentiment, and negative divergences are highly evident," David Rosenberg, economist and strategist at Gluskin Sheff in Toronto wrote in his daily analysis. "Just as the economics community was doing radical surgery right at the July-August lows in the market, it is now raising its growth projections right at the highs. That is a contrary warning shot."

"Companies Cling to Cash" Corporate America's cash pile has hit its highest level in half a century. The cash buildup shows the deep caution many companies feel about investing in expansion while the economic recovery remains painfully slow and high unemployment and battered household finances continue to limit consumers' ability to spend. "The corporate sector is looking at the household sector and saying, this is not the environment where we should expand our business," said Deutsche Bank economist Torsten Slok.

Tuesday, December 7, 2010

Spanish Woman Claims Ownership of the Sun, Plans to Begin Charging for Use

The Daily Feed Newsletter

A 49-year-old Spanish woman named Angeles Duran has registered ownership of the sun in her name, with the help of a local notary.

Yes, the sun. As in, the actual sun.

The official document attests that she is the "owner of the Sun, a star of spectral type G2, located in the centre of the solar system, located at an average distance from Earth of about 149,600,000 kilometers."

According to El Mundo, Duran "took the step in September after reading about an American man who had registered himself as the owner of the moon and most planets in our solar system."

"I backed my claim legally, I am not stupid, I know the law," she said -- although she has not yet figured out how to collect payment from the residents of planet Earth.

At least one citizen isn't ready to pony up for his daily dose of sunshine.

"Aries Dragon" of Texas, writes:

"I cannot pay and I do not foresee being able to pay in the near future. Please discontinue my service immediately. I will notify you when I am ready to resume."

A 49-year-old Spanish woman named Angeles Duran has registered ownership of the sun in her name, with the help of a local notary.

Yes, the sun. As in, the actual sun.

The official document attests that she is the "owner of the Sun, a star of spectral type G2, located in the centre of the solar system, located at an average distance from Earth of about 149,600,000 kilometers."

According to El Mundo, Duran "took the step in September after reading about an American man who had registered himself as the owner of the moon and most planets in our solar system."

"I backed my claim legally, I am not stupid, I know the law," she said -- although she has not yet figured out how to collect payment from the residents of planet Earth.

At least one citizen isn't ready to pony up for his daily dose of sunshine.

"Aries Dragon" of Texas, writes:

"I cannot pay and I do not foresee being able to pay in the near future. Please discontinue my service immediately. I will notify you when I am ready to resume."

Saturday, December 4, 2010

How to Build a $1000 Fusion Reactor in Your Basement

This article is a sample from DISCOVER's special Extreme Universe issue, available only on newsstands through March 22.

Most college freshmen fill their dorm rooms with clothes, books, and electronics. Thiago Olson also brought his fusion reactor. But Vanderbilt University drew the line: No do-it-yourself reactors in the dorm! Instead, his device was housed in a nearby laboratory.

Olson and a small cadre of other amateur nuclear engineers have found a simpler way. They are creating home-grown reactors, welding and wiring the devices in their backyards, garages, and basements (much to the alarm of neighbors). The hazards to the community are slim, the main ones being heavy use of electricity and short-range radiation that can be of risk to the “fusioneers” themselves. You can find out more about building a fusion reactor at www.fusor.net, an online community of fusioneers who help each other find parts, assemble, and problem solve. Also, check out a pair of books, Radiation Detection and Measurement by Glenn F. Knoll and Building Scientific Apparatus by John H. Moore.

If you decide to proceed, though, a few cautions: Beware of high-voltage electricity, which can skyrocket to more than 50,000 volts—enough that contact with a loose wire will kill you instantly. Pressurized flammable gas can also be fatal. And electrons hitting the stainless steel chamber produce X-rays, so do not look at the little window directly. Instead use a camera or leaded glass filter. Contact your state’s department of health for regulations. Your reactor will use a lot more energy than it produces. It is barely capable of achieving a detectable nuclear reaction, so fusion is one of the least hazardous parts of this project.

For those who would like to join in on the fusion fun, DISCOVER offers this guide to the essentials. With a lot of scrounging for cheap parts online or at scrapyards, plus a lot of elbow grease, it is possible to put together a fusion reactor for as little as $1,000. If you need fusion right now, though, you can pay retail and get what you need for about $20,000.

Olson’s project was motivated by the challenge of doing fusion—and by the same promise that has inspired thousands of physicists over the past half century. Nuclear fusion is the energy source that powers the sun; if channeled correctly, it could become a major source of clean energy here on Earth. Fusion occurs when the nuclei of two atoms are forced so close to each other that they bind together, releasing a great deal of energy in the process. Because positively charged nuclei forcefully repel each other, though, high temperatures are needed to bring about a union. Most fusion reactors are therefore enormous machines, like the $3.5 billion National Ignition Facility that recently opened in California.

RADIATION DETECTION EQUIPMENT Prove that you really achieved fusion by using a bubble dosimeter, which provides instant visual verification and measurement of neutrons produced by fusion reactions. If you get bubbles, you did it! Price: $120

VACUUM CHAMBER Get a stainless steel chamber to seal your fusion particles in and to keep air out. Olson’s vacuum is made from an old mass spectrometer he found on eBay. You will probably need a lot of bolts to get the chamber closed tightly, and possibly a large flange for patching up a gaping hole, which can cost $500. If you are a student, try asking the manufacturer for a discount. Price: $300–$4,000

DEUTERIUM The atomic nuclei in the hydrogen plasma are what collide to create fusion inside the chamber. Deuterium, or heavy hydrogen, is found in seawater, but it is hard to separate from its far more common, lighter cousin. Its distribution is also tightly regulated due to its close ties to nuclear technology. Unless you have special connections, a business or university will need to request it on your behalf. Price: around $250 for 50 liters of gas in a lecture bottle

HIGH-VOLTAGE POWER You will need at least 20,000 volts* and a 10-milliamp current to create enough heat to crush those hydrogen nuclei together. Remember that because you are trying to attract positive deuterium ions, you want negative output, so you must ground the positive charge. Olson uses an X-ray transformer salvaged from an old mammogram machine. A commercial power supply by Spellman or Glassman is another option, or the intrepid electrician can make one from scratch. Price: $400–$10,000

VACUUM PUMP Suck all the unwanted particles out of the chamber. A two-stage roughing pump will get you to a near vacuum. Then use a turbo or oil diffusion pump to reach a high vacuum. Price: $350–$4,000

GAS REGULATOR Use this to inject tiny amounts of deuterium into the chamber and to regulate pressure inside your reactor. Needle valves can fine-tune the amount going in; capillary tubing (with an inner diameter as narrow as a pin) will really slow it down. If you can afford to, forget those and instead use a mass flow controller, which allows you to delegate the job to your computer. Price: $100–$200

* Correction, March 3: This originally read "50,000 volts."

Most college freshmen fill their dorm rooms with clothes, books, and electronics. Thiago Olson also brought his fusion reactor. But Vanderbilt University drew the line: No do-it-yourself reactors in the dorm! Instead, his device was housed in a nearby laboratory.

Olson and a small cadre of other amateur nuclear engineers have found a simpler way. They are creating home-grown reactors, welding and wiring the devices in their backyards, garages, and basements (much to the alarm of neighbors). The hazards to the community are slim, the main ones being heavy use of electricity and short-range radiation that can be of risk to the “fusioneers” themselves. You can find out more about building a fusion reactor at www.fusor.net, an online community of fusioneers who help each other find parts, assemble, and problem solve. Also, check out a pair of books, Radiation Detection and Measurement by Glenn F. Knoll and Building Scientific Apparatus by John H. Moore.

If you decide to proceed, though, a few cautions: Beware of high-voltage electricity, which can skyrocket to more than 50,000 volts—enough that contact with a loose wire will kill you instantly. Pressurized flammable gas can also be fatal. And electrons hitting the stainless steel chamber produce X-rays, so do not look at the little window directly. Instead use a camera or leaded glass filter. Contact your state’s department of health for regulations. Your reactor will use a lot more energy than it produces. It is barely capable of achieving a detectable nuclear reaction, so fusion is one of the least hazardous parts of this project.

For those who would like to join in on the fusion fun, DISCOVER offers this guide to the essentials. With a lot of scrounging for cheap parts online or at scrapyards, plus a lot of elbow grease, it is possible to put together a fusion reactor for as little as $1,000. If you need fusion right now, though, you can pay retail and get what you need for about $20,000.

Olson’s project was motivated by the challenge of doing fusion—and by the same promise that has inspired thousands of physicists over the past half century. Nuclear fusion is the energy source that powers the sun; if channeled correctly, it could become a major source of clean energy here on Earth. Fusion occurs when the nuclei of two atoms are forced so close to each other that they bind together, releasing a great deal of energy in the process. Because positively charged nuclei forcefully repel each other, though, high temperatures are needed to bring about a union. Most fusion reactors are therefore enormous machines, like the $3.5 billion National Ignition Facility that recently opened in California.

RADIATION DETECTION EQUIPMENT Prove that you really achieved fusion by using a bubble dosimeter, which provides instant visual verification and measurement of neutrons produced by fusion reactions. If you get bubbles, you did it! Price: $120

VACUUM CHAMBER Get a stainless steel chamber to seal your fusion particles in and to keep air out. Olson’s vacuum is made from an old mass spectrometer he found on eBay. You will probably need a lot of bolts to get the chamber closed tightly, and possibly a large flange for patching up a gaping hole, which can cost $500. If you are a student, try asking the manufacturer for a discount. Price: $300–$4,000

DEUTERIUM The atomic nuclei in the hydrogen plasma are what collide to create fusion inside the chamber. Deuterium, or heavy hydrogen, is found in seawater, but it is hard to separate from its far more common, lighter cousin. Its distribution is also tightly regulated due to its close ties to nuclear technology. Unless you have special connections, a business or university will need to request it on your behalf. Price: around $250 for 50 liters of gas in a lecture bottle

HIGH-VOLTAGE POWER You will need at least 20,000 volts* and a 10-milliamp current to create enough heat to crush those hydrogen nuclei together. Remember that because you are trying to attract positive deuterium ions, you want negative output, so you must ground the positive charge. Olson uses an X-ray transformer salvaged from an old mammogram machine. A commercial power supply by Spellman or Glassman is another option, or the intrepid electrician can make one from scratch. Price: $400–$10,000

VACUUM PUMP Suck all the unwanted particles out of the chamber. A two-stage roughing pump will get you to a near vacuum. Then use a turbo or oil diffusion pump to reach a high vacuum. Price: $350–$4,000

GAS REGULATOR Use this to inject tiny amounts of deuterium into the chamber and to regulate pressure inside your reactor. Needle valves can fine-tune the amount going in; capillary tubing (with an inner diameter as narrow as a pin) will really slow it down. If you can afford to, forget those and instead use a mass flow controller, which allows you to delegate the job to your computer. Price: $100–$200

* Correction, March 3: This originally read "50,000 volts."

Friday, December 3, 2010

Market Approaches Year High In The Beginning Of December

Market moves violently in this week and approaches year high at the end of week on the last month of year. It can be seen that market participants become more active and create turbulence in the equity stock market. In the beginning two days of the week, hedge funds attempted to move down the market after the opening bell. Since selling pressure was very limited. market gained support from individual investors who started to enter the market in November. After two days of unsuccessful attempt and seeing the strong support from individual investors, hedge funds changed the strategy from selling to buying and ignited the following three-day rally. Individual investors and hedge funds together pushed the market higher with increased trading volume.

Market sentiment turns optimistic. Capital is probably flowing from treasuries and bond market to equity stock market. However hedge funds are opportunistic traders seeking short term profit from market fluctuation in up or down direction. Another potential impact on equity stock performance is the tax cut expiration. After the 2008 financial crisis, wealth is more concentrated on the rich people because they are buying diverse assets while the majority of people are frightened by the market decline and liquidating the investment portfolio to save in money market. Depending on tax planning of rich people, profit realisation on capital gain before tax cut expiration may generate selling pressure.

Long term outlook on market performance is optimistic as discussed many times in the past. However, short term market movement is more dependent on market participants, rather than economic condition. There is ample liquidity in the capital market and it appears that investors are becoming more interested in the equity stock market. However, household are still very

cautious on buying stocks. Movement of market is range bounded. With increased activities from market participants, range is widened with increased volatility.

Leveraging on trading portfolio is very risky under current market condition. For long term investment, holding power is very important to preserve portfolio value and appreciation. For short term trading, risk mitigation is critical to successful strategy.

Market sentiment turns optimistic. Capital is probably flowing from treasuries and bond market to equity stock market. However hedge funds are opportunistic traders seeking short term profit from market fluctuation in up or down direction. Another potential impact on equity stock performance is the tax cut expiration. After the 2008 financial crisis, wealth is more concentrated on the rich people because they are buying diverse assets while the majority of people are frightened by the market decline and liquidating the investment portfolio to save in money market. Depending on tax planning of rich people, profit realisation on capital gain before tax cut expiration may generate selling pressure.

Long term outlook on market performance is optimistic as discussed many times in the past. However, short term market movement is more dependent on market participants, rather than economic condition. There is ample liquidity in the capital market and it appears that investors are becoming more interested in the equity stock market. However, household are still very

cautious on buying stocks. Movement of market is range bounded. With increased activities from market participants, range is widened with increased volatility.

Leveraging on trading portfolio is very risky under current market condition. For long term investment, holding power is very important to preserve portfolio value and appreciation. For short term trading, risk mitigation is critical to successful strategy.

Tuesday, November 30, 2010

Enigma Being Auctioned By Christie’s On November 23rd, 2010

Reprinted from Christie's.

LOT 59 / SALE 7882

Price Realized £67,250 ($107,129)

Price includes buyer's premium

Sale Information

Sale 7882

Valuable Printed Books and Manuscripts

23 November 2010

London, King Street

'ENIGMA' -- Cipher Machine. A three-rotor Enigma machine, number A-9457, with electric core, three aluminium rotors each stamped WaA618, raised 'QWERTZ' keyboard with crackle black painted metal case (some restoration), three division window flap over rotors and plugboard in the front with ten patch leads, with metal label 'C

hiffriermaschinen Gesellschaft Heimsoeth und Rinke, Berlin W.35 Ludendorffstraße 6' on the inside of the lid, circa 1939. Modern power supply. 260 x 320 x 140mm.

Lot Description

'ENIGMA' -- Cipher Machine. A three-rotor Enigma machine, number A-9457, with electric core, three aluminium rotors each stamped WaA618, raised 'QWERTZ' keyboard with crackle black painted metal case (some restoration), three division window flap over rotors and plugboard in the front with ten patch leads, with metal label 'Chiffriermaschinen Gesellschaft Heimsoeth und Rinke, Berlin W.35 Ludendorffstraße 6' on the inside of the lid, circa 1939. Modern power supply. 260 x 320 x 140mm.

A three-rotor ENIGMA, the standard German electronic ciphering machine widely used in World War II. It derives from a 1919 patent of a Dutch inventor, H.A. Koch; an early design marketed by Dr. Arthur Scherbius was bought out by the German military in 1929 and placed in service. ENIGMA in several variants was used by the German Navy, the Wehrmacht, the Luftwaffe, the state railroad system, the Abwehr (intelligence) and the SS.

It was designed with a complex, interchangeable series of three rotors bearing the 26-character alphabet, a 'reflector' and a plugboard with movable connecting cords that connected pairs of letters. As an added precaution, the base or starting settings for the rotors was changed every 24 hours, according to pre-printed setting registers furnished in advance or supplied daily by courier. It has been calculated that the 3-rotor ENIGMA, with plugboard in use, made possible a total of 15 billion billion possible readings for each character.

ENIGMA was widely regarded by the Germans as too complex to be broken, but in the 1930s a team of Polish analysts (Marian Rejewski, Jerzy Rszycki and Henryk Zygalski), made remarkable progress in working out the machine's basic system, identified its vulnerabilities and succeeded in deciphering much of the encrypted German radio traffic. Their findings, including plans for very useful mechanical devices known as 'bombes', which aided in the decryption operation, were secretly passed on in 1939 to French and British investigators. An elite team of cryptanalysts, mathematicians and engineers including Alan Turing (see lot 60) were established in a top-secret facility at Bletchley Park. For the rest of the war that legendary team's heroic and unstinting efforts gradually accomplished the seemingly insurmountable task of deciphering an enormous volume of encrypted communications. The critical intelligence deriving from their decipherment was dubbed ULTRA and was employed cautiously but to great effect during the war; some commentators credit ULTRA with shortening the war by some two years.

LOT 59 / SALE 7882

Price Realized £67,250 ($107,129)

Price includes buyer's premium

Sale Information

Sale 7882

Valuable Printed Books and Manuscripts

23 November 2010

London, King Street

'ENIGMA' -- Cipher Machine. A three-rotor Enigma machine, number A-9457, with electric core, three aluminium rotors each stamped WaA618, raised 'QWERTZ' keyboard with crackle black painted metal case (some restoration), three division window flap over rotors and plugboard in the front with ten patch leads, with metal label 'C

hiffriermaschinen Gesellschaft Heimsoeth und Rinke, Berlin W.35 Ludendorffstraße 6' on the inside of the lid, circa 1939. Modern power supply. 260 x 320 x 140mm.

Lot Description

'ENIGMA' -- Cipher Machine. A three-rotor Enigma machine, number A-9457, with electric core, three aluminium rotors each stamped WaA618, raised 'QWERTZ' keyboard with crackle black painted metal case (some restoration), three division window flap over rotors and plugboard in the front with ten patch leads, with metal label 'Chiffriermaschinen Gesellschaft Heimsoeth und Rinke, Berlin W.35 Ludendorffstraße 6' on the inside of the lid, circa 1939. Modern power supply. 260 x 320 x 140mm.

A three-rotor ENIGMA, the standard German electronic ciphering machine widely used in World War II. It derives from a 1919 patent of a Dutch inventor, H.A. Koch; an early design marketed by Dr. Arthur Scherbius was bought out by the German military in 1929 and placed in service. ENIGMA in several variants was used by the German Navy, the Wehrmacht, the Luftwaffe, the state railroad system, the Abwehr (intelligence) and the SS.

It was designed with a complex, interchangeable series of three rotors bearing the 26-character alphabet, a 'reflector' and a plugboard with movable connecting cords that connected pairs of letters. As an added precaution, the base or starting settings for the rotors was changed every 24 hours, according to pre-printed setting registers furnished in advance or supplied daily by courier. It has been calculated that the 3-rotor ENIGMA, with plugboard in use, made possible a total of 15 billion billion possible readings for each character.

ENIGMA was widely regarded by the Germans as too complex to be broken, but in the 1930s a team of Polish analysts (Marian Rejewski, Jerzy Rszycki and Henryk Zygalski), made remarkable progress in working out the machine's basic system, identified its vulnerabilities and succeeded in deciphering much of the encrypted German radio traffic. Their findings, including plans for very useful mechanical devices known as 'bombes', which aided in the decryption operation, were secretly passed on in 1939 to French and British investigators. An elite team of cryptanalysts, mathematicians and engineers including Alan Turing (see lot 60) were established in a top-secret facility at Bletchley Park. For the rest of the war that legendary team's heroic and unstinting efforts gradually accomplished the seemingly insurmountable task of deciphering an enormous volume of encrypted communications. The critical intelligence deriving from their decipherment was dubbed ULTRA and was employed cautiously but to great effect during the war; some commentators credit ULTRA with shortening the war by some two years.

Update 2: Apple 1 And Paperwork Being Auctioned By Christie’s On November 23rd, 2010

Additional information on auction details. Reprinted from San Jose Mercury News.

Cassidy: Apple 1 sells at Christie's auction for $212,267

By Mike Cassidy

Mercury News Columnist

Come on. $212,000?

I mean the Apple-1 is a fine machine and all. It's portable. No monitor to get all smudged the way that iPad screen does. (No keyboard either, which is sort of like the iPad.) But the thing is 34 years old and it's been god-knows where. It's a glorified piece of plastic, for goodness sake. It looks like something you'd find in a Dumpster behind some high-tech startup, rather than one of the world's first personal computers.

No matter. Italian magnate Marco Boglione stepped up at an auction Tuesday and paid nearly a quarter of a million at Christie's of London for one of the PCs that Steve Wozniak and Steve Jobs built in Jobs' garage. (It must kill Jobs that he doesn't get a cut.) Yes, it's the Apple-1, which arguably launched the personal computer revolution and certainly launched Apple, a technology company that is slowly seeping into every aspect of our lives.

"It's a very nice representative example," says Sellam Ismail, of Livermore, who founded the Vintage Computer Festival. "It's probably one of the most complete, and in good condition, that I've ever come across."

And that's what I'd go with if I were Marco Boglione and it came time to share the glorious news with my significant other. I certainly wouldn't go with Ismail's first reaction: "I guess they found the one stupid guy with a lot of money," although Ismail later backed off that harsh assessment.

But $212,000?

"No," says Ismail, who's brokered the sales of a half-dozen Apple-1s, none for more than $30,000.

But beauty is in the eye of the beholder.

No matter that for the price of Boglione's Apple-1, you could buy 425 über-cool iPads. No matter that you could run down to the Apple Store and score the sleek new MacBook Air for 1/212th the cost. No matter that Boglione's Apple-1 comes with 8 kilobytes of memory and a cassette interface for storage, instead of, say, 500 gigabytes in today's low-end iMac.

It is a piece of history. Wozniak himself attended the auction.

The Apple-1, after all, was Apple's first PC. It came with a pre-assembled motherboard, a major convenience in the day of hobbyist computer kits. Wozniak and Jobs started shipping the 200 or so Apple-1s in 1976, charging $666.66 for the machine. (No, they weren't closet devil worshipers. The Steves wanted a 33 percent markup from their $500 wholesale price and Woz liked repeating numbers. So, $666.66.) About 50 survive today.

I couldn't reach Boglione, 54, on Tuesday. An e-mail sent to his sportswear conglomerate in Turin, Italy, after hours there went unanswered. But here's what we know about him: He's got a lot of money.

He also studied engineering at Turin Polytechnic, went into the advertising business and in 1983 founded BasicNet, according to the company website.

Had I reached Boglione, he might have explained that he got more than just an old computer for his $212,000. The sale included a personal letter from Jobs typed on lined paper and the original shipping box, addressed to Frank Anderson at Electric City Radio Supply in Great Falls, Mont.

And lest you doubt the historical significance of the great machine, you should know that it's still recalled in Great Falls today.

"I remember seeing it when he first got it," says Scott Stafford, 52, who shopped in Anderson's store when he was in high school. "He was the first person that I ever knew to have a personal computer."

Stafford always admired Anderson, who passed away years ago.

He named his audio-video installation business Electric City Sight & Sound in part as a tribute.

So what does he think about his old mentor's computer going for more than $200,000 at auction?

On the other end of the phone, Stafford starts laughing loud and long. To be honest, I'm not sure he has stopped yet.

Cassidy: Apple 1 sells at Christie's auction for $212,267

By Mike Cassidy

Mercury News Columnist

Come on. $212,000?

I mean the Apple-1 is a fine machine and all. It's portable. No monitor to get all smudged the way that iPad screen does. (No keyboard either, which is sort of like the iPad.) But the thing is 34 years old and it's been god-knows where. It's a glorified piece of plastic, for goodness sake. It looks like something you'd find in a Dumpster behind some high-tech startup, rather than one of the world's first personal computers.

No matter. Italian magnate Marco Boglione stepped up at an auction Tuesday and paid nearly a quarter of a million at Christie's of London for one of the PCs that Steve Wozniak and Steve Jobs built in Jobs' garage. (It must kill Jobs that he doesn't get a cut.) Yes, it's the Apple-1, which arguably launched the personal computer revolution and certainly launched Apple, a technology company that is slowly seeping into every aspect of our lives.

"It's a very nice representative example," says Sellam Ismail, of Livermore, who founded the Vintage Computer Festival. "It's probably one of the most complete, and in good condition, that I've ever come across."

And that's what I'd go with if I were Marco Boglione and it came time to share the glorious news with my significant other. I certainly wouldn't go with Ismail's first reaction: "I guess they found the one stupid guy with a lot of money," although Ismail later backed off that harsh assessment.

But $212,000?

"No," says Ismail, who's brokered the sales of a half-dozen Apple-1s, none for more than $30,000.

But beauty is in the eye of the beholder.

No matter that for the price of Boglione's Apple-1, you could buy 425 über-cool iPads. No matter that you could run down to the Apple Store and score the sleek new MacBook Air for 1/212th the cost. No matter that Boglione's Apple-1 comes with 8 kilobytes of memory and a cassette interface for storage, instead of, say, 500 gigabytes in today's low-end iMac.

It is a piece of history. Wozniak himself attended the auction.

The Apple-1, after all, was Apple's first PC. It came with a pre-assembled motherboard, a major convenience in the day of hobbyist computer kits. Wozniak and Jobs started shipping the 200 or so Apple-1s in 1976, charging $666.66 for the machine. (No, they weren't closet devil worshipers. The Steves wanted a 33 percent markup from their $500 wholesale price and Woz liked repeating numbers. So, $666.66.) About 50 survive today.

I couldn't reach Boglione, 54, on Tuesday. An e-mail sent to his sportswear conglomerate in Turin, Italy, after hours there went unanswered. But here's what we know about him: He's got a lot of money.

He also studied engineering at Turin Polytechnic, went into the advertising business and in 1983 founded BasicNet, according to the company website.

Had I reached Boglione, he might have explained that he got more than just an old computer for his $212,000. The sale included a personal letter from Jobs typed on lined paper and the original shipping box, addressed to Frank Anderson at Electric City Radio Supply in Great Falls, Mont.

And lest you doubt the historical significance of the great machine, you should know that it's still recalled in Great Falls today.

"I remember seeing it when he first got it," says Scott Stafford, 52, who shopped in Anderson's store when he was in high school. "He was the first person that I ever knew to have a personal computer."

Stafford always admired Anderson, who passed away years ago.

He named his audio-video installation business Electric City Sight & Sound in part as a tribute.

So what does he think about his old mentor's computer going for more than $200,000 at auction?

On the other end of the phone, Stafford starts laughing loud and long. To be honest, I'm not sure he has stopped yet.

Friday, November 26, 2010

Update: Apple 1 And Paperwork Being Auctioned By Christie’s On November 23rd, 2010

The Christie's auction "Lot 65 / Sale 7882 APPLE-1 -- Personal Computer" final price realized is £133,250 (Price includes buyer's premium).

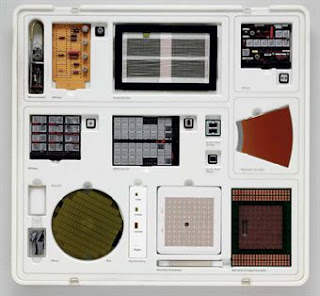

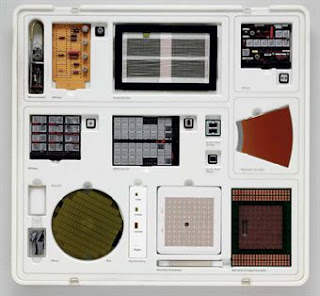

An upcoming auction for vintage computer in Christie's is "Lot 392 / Sale 2361 [COMPUTING]. -- IBM. "Computertechnologie." Stuttgart, 1986." held on 3rd December 2010. The estimate is $3000 to $5000.

Lot Description

[COMPUTING]. -- IBM. "Computertechnologie." Stuttgart, 1986.

Carrying case lettered "Computertechnologie IBM" containing two plastic trays: the first displaying computer components (circuit boards, chips, wafers, quartz, silicon, etc), the second containing four instructional manuals, one VHS tape and a 30x microscope. Overall size 500 x 530 mm.

A FINELY PRESERVED INSTRUCTIONAL KIT, designed by IBM for the instruction of developing computer technology. The manuals include Computertechnologie Textbuch and Computertechnologie Folien. The included magnifying glass would allow viewers to see details of the chips and wafers included in the first display tray.

Pre-Lot Text

THE PROPERTY OF A GENTLEMAN

Department Information

Books & Manuscripts

An upcoming auction for vintage computer in Christie's is "Lot 392 / Sale 2361 [COMPUTING]. -- IBM. "Computertechnologie." Stuttgart, 1986." held on 3rd December 2010. The estimate is $3000 to $5000.

Lot Description

[COMPUTING]. -- IBM. "Computertechnologie." Stuttgart, 1986.

Carrying case lettered "Computertechnologie IBM" containing two plastic trays: the first displaying computer components (circuit boards, chips, wafers, quartz, silicon, etc), the second containing four instructional manuals, one VHS tape and a 30x microscope. Overall size 500 x 530 mm.

A FINELY PRESERVED INSTRUCTIONAL KIT, designed by IBM for the instruction of developing computer technology. The manuals include Computertechnologie Textbuch and Computertechnologie Folien. The included magnifying glass would allow viewers to see details of the chips and wafers included in the first display tray.

Pre-Lot Text

THE PROPERTY OF A GENTLEMAN

Department Information

Books & Manuscripts

Equity Stock Market Retreats on Calm Week

Market ends lower with less trading days and shortened hours on last day. Institutional investors should have completed portfolio trimming. But some hedge funds are still speculating on further market retrenchment. Their selling was followed by some day traders and individual investors. As mentioned in the article "The One Number That Spells Market Upside or Downside in 2011", in this kind of market, it's wise to take profits when you can on any short-term moves while sitting tight on your long-term core holdings.

Although buying demand from individual investors appears to vanish in this week, investors are holding tight on existing portfolio. When the market declines, trading volume remains low whether the magnitude is large or small. This indicates that trading activities are mainly from day traders whether institutional or individual. As mentioned in earlier post, current market level should have support from individual investors. However, the confidence is still low because of stagnant economic growth despite soaring corporate earnings which boost investors' interest on stock. Since hedge fund can make profit on either market movement direction, there is probability that hedge fund can use herd behaviour to manipulate down the market for profit and to accumulate position for future appreciation. There may or may not be better entry point later for value investment. But long-term investors can still profit from cost averaging under current environment.

"Good for GM, Bad for Stocks?" Investors' stock-buying appetite is still hearty. After all, money has started to flow into stock funds again, and this year's U.S. debutantes are up an eye-catching 15%. Of course, whether investors will keep purchasing stocks depends ultimately on the state of the economy, and the surprises it holds. If it's any consolation, today's bulls are a fickle, faithless bunch, their optimism cloaked in layers of qualifiers and caveats, and they change their minds quicker than teenagers do.

The wealth effect has started to surface. From Yahoo! article, "Signs of Swagger, Wallets Out, Wall St. Dares to Indulge", exuberance made a comeback this year at Josh Koplewicz's annual Halloween party. More than 1,000 people packed into a 6,000-square-foot space at the Good Units night club in Manhattan, a substantially larger crowd than in the last several years. The scene was more extravagant in September, at a 50th birthday party in Hong Kong for Brian Brille, the head of Bank of America Asia Pacific.

Two years after the onset of the financial crisis, the stock market is recovering and Wall Street's moneyed elite are breathing easier again. And this means in some cases they are spending again - at times cautiously, but sometimes with a familiar swagger. Expensive restaurants report a pickup in bookings. Real estate agents say Wall Street executives have already begun lining up rentals in the Hamptons for next summer. Christie's auction house says investors from the financial world who fell out of the bidding market during the 2008 credit crisis are "pouring" back in. Most expenditures, however, are for more mainstream indulgences. Marc B. Porter, a senior executive at Christie's, says Wall Street workers for whom the auction market was recently seen as "out of range" are pouring back in. This resurgence of activity, he says, has followed the recovery of different economies, be it Hong Kong or the United States.

Lack of interest from the majority of household investors is the major bottleneck of market uptrend. "Probe leads investors to wonder: Is game rigged?" "A large part of trading has to do with trust, and I don't have it," says Mark Swenson, a 43-year-old plumber from New Hampshire who refuses to buy individual stocks. Even before news broke that federal investigators were looking into whether hedge funds traded on inside information, small-time investors were pulling their money out of stocks -- despite a remarkable run for the market since the spring of 2009.

Some pros on Wall Street say hesitation by small investors is good news. It means that there's plenty of "dry powder" to propel the market higher in the next few months when and if the little guy finally relents and joins in the rally. The insider-trading probe could test that theory.

It's not the first time small investors have been scared out of stocks. Charles Geisst, a finance professor at Manhattan College who has written 18 books on the history of markets, says investors balked at buying for years after the Crash of 1929 and Black Monday in 1987. The view both times: The odds are stacked against the little guy.

The market needs them back. Most of the stock in U.S. companies, both public and private, is held by individuals, not institutions, according to Federal Reserve data. Small investors may be comforted to know that professional investors don't always fare better, even with the edge they have over the masses. "The edge is hugely exaggerated," says Richard Ferri, founder of the investment advisory firm Portfolio Solutions and an advocate of low-cost index funds. "If the small investor does the right thing, he can do better than 99 percent of anyone else."