【星島日報綜合報道】香港回歸十五周年,國家主席胡錦濤來港主持新管治班子就職儀式。胡總這次香港行,除了參加慶典,會晤官員及各界,「重頭戲」之一便是親訪尋常百姓家,了解香港的實況,如關乎民生大事的住屋問題,胡總便親臨地盤,走入單位視察裏面的設計,這正是中央領導人一貫的最大關注。現時特區政府在財政上具備充足條件,下任政府繼往開來,必須做好對市民生計的關心,才不負中央所託。

今天,香港特別行政區開始新的十五年,新政府班子正式肩負起繼往開來的使命。過去兩任行政長官,先後為特區奠定了平穩過渡和經濟發展的基礎;新政府推動經濟更上層樓之外,在改善民生方面多下工夫,讓市民分享經濟成果。

十五年來,本港經歷金融風暴和疫症等種種風浪考驗,透過港人的努力和官員的應變,更把握內地經濟騰飛帶來的龐大機遇,令特區在一國兩制下茁壯成長,經濟增長傲視發達國家,並且在優勢互補下,為國家作出不少貢獻。

社會財富增市民應分沾

回歸以來的兩任特首,並非完美無瑕,中央從歷史角度和宏觀視野,肯定了他們的貢獻。董建華完成了令香港順利過渡、一國兩制成功扎根的歷史任務﹔曾蔭權則進一步令特區經濟站穩陣腳,成功抵禦外來衝擊,令經濟欣欣向榮,國民生產總值迭創新高,最新失業率降至百分之三點二,幾近全民就業,政府則累積豐厚財力來推行政策和應付突變。

在財富增加下,社會分享財富的訴求自然增加,這不單是基層,還包括不少中產人士。在市民每月入息中位數超過兩萬元之際,全港最低收入一成住戶的入息中位數卻只得二千零七十元,比一九九七年的四千三百元,下跌逾五成。去年開始實施的最低工資制度,有助縮窄這方面的貧富差距,梁振英領導下的新政府,大有條件在改善基層民生方面多下工夫。

本港經濟從二○○三年谷低回升,財富迅速增長,透過滴漏效應惠及各階層已嫌太慢,基於社會累積財富增加,只要維持平穩發展的勢頭,優化福利政策的條件逐漸具備,因而進入以行政措施來搞好財富再分配的發展階段。

創富是手段要福為民開

胡錦濤今次香港行,帶來更多的中央惠港措施,當大眾把注意力放在各類金融「大禮」之際,中央官員十五年來卻是從全方位着手,由確保副食品的供應和品質安全,到額外容許出口海沙來港支援建屋需要,關顧廣泛民生需求,就算按照國家戰略需要發展金融,這些苦心說到底,就是希望從中帶來的經濟增長,能夠改善民生。

梁振英以基層出身的形象,加上關顧基層的選舉工程,成為他贏取基層市民支持的重要條件。香港經歷回歸十五年的發展,中間有過順逆,總體發展還是有較明顯的進展,當局應積極關注基層醫療、教育,以至中產人士面對樓價跑贏工資的置業難題。

中央經常掛在口邊的其中一句說話,是福為民開,經濟發展是手段,改善人民生活才是目標。過去十五年的努力,鞏固了香港的經濟基礎,讓梁振英政府有較好的財政條件去推行政策,而進一步發展經濟之餘,同時專注做好醫療、教育、房屋等民生大事,相信是胡總和中央對新政府未來五年工作的主要期盼。

Saturday, June 30, 2012

Alpha Market Research, Inc. Update (June 2012)

The website begins operation in 2010 and expires on May 2012.

News Release (Aug 24, 2010): Alpha Market Research To Launch Largest Website-tester Network In The World

Message from CEO Michael Anthony DeBias - 2010-09-20

News Release (Aug 24, 2010): Alpha Market Research To Launch Largest Website-tester Network In The World

Message from CEO Michael Anthony DeBias - 2010-09-20

Friday, June 29, 2012

Smart Money Finding Bargains In Wealth Assets

Equity stock market surges at half year end. Trading activities remain low while market participants are still cautious. Selling is limited since market bottom is reached a few weeks ago. Investors are holding cash to look around for bargains.

Market manipulators have not been able to trigger panic selling despite bearish market sentiment. Market participants do not have much confidence in equity stocks but are not willing to dump the core holding stocks in the portfolio. Therefore trading volume comes mainly from day traders.

As market manipulators are no longer short selling stocks, market participants are less worry of market collapse and begin to pick bargains during pullback. The outlook for wealth assets in the second half year is positive since capital are flowing from low yield money market to riskier assets.

4 Catalysts to Spark an S&P 500 Rally to 1,500

Jim Paulsen, chief investment strategist at Wells Capital Management, is sticking by his year-end target of 1,500 on the S&P 500. He's zeroing in on four main catalysts that could spark a rally in the second-half of the year.

First up is Europe. Yes, Europe. Despite the market selling off on the latest round of concerns that nothing will emerge from another European Summit at the end of this week, Paulsen says we've seen this before and it's simply not the crisis it was once considered. He calls it more of a "chronic problem" that will be with us for the next decade, rather than a full-blown imminent threat.

"We've seen how this works out, the Euro fears flare, the market sells off, then they calm down and we go on to new highs," he says. "So rather than Europe fears flaring as a sell signal, I think what it has represented for the last two years is a good buying opportunity."

Second, Paulsen is as bullish on the U.S. economy as it gets these days. In his view, investors are too focused on China and Europe, and overlooking underlying strengths domestically. While overseas economies matter, he believes this year's U.S. growth data has been overstated, understated, and is now balancing out at about 2.5%.

Third, Paulsen points to emerging market economies.

"To me the biggest risk we face is not Europe, it's a recession in the emerging world. If that happens I think the global recovery is over," he states.

But Paulsen sees this as a low probability risk due to accommodative policy measures taken last Fall that will ultimately fuel those key economies to higher growth levels. He believes we'll see evidence of China's slowdown bottoming by the start of the fourth-quarter.

Finally, Paulsen points to earnings multiples. In his latest research note he cities the following:

Trailing 12-month earnings per share are now about $100. Therefore, the price-earnings multiple (PE) on trailing earnings is now slightly less than 13 times and the PE based on year-end consensus estimated earnings is currently less than 12.3 times.

"I think it's cheap," states Paulsen confidently. "We've never in the post-War era had this low of multiples when interest rates and inflation were also this low."

'Check Engine' Light for US Economic Driver Is On

If small business is the economic engine that makes America go, then it's clear the "check engine" light is now on.

New data from the small business analytics firm PayNet shows investments by small manufacturers slowed down substantially in the first quarter. Even more worrisome, those business owners are cautious about growth in the second half of this year. "It's surprising. It's a cooling off," says William Phelan, PayNet's co-founder and president. "If you see the relative changes going on here you can say they really have become more cautious and started to jam on the brakes."

If small business is the economic engine that makes America go, then it's clear the "check engine" light is now on.

New data from the small business analytics firm PayNet shows investments by small manufacturers slowed down substantially in the first quarter. Even more worrisome, those business owners are cautious about growth in the second half of this year. "It's surprising. It's a cooling off," says William Phelan, PayNet's co-founder and president. "If you see the relative changes going on here you can say they really have become more cautious and started to jam on the brakes."

Stocks to Bottom This Week: Charles Nenner

With stocks bonds and gold careening between hope and greed every few days Nenner updated his views and price targets for each of the Big Three.

Stocks

Having been true to his word and taken money off the table in stocks 3 months ago, Nenner is looking to start getting long again this week. Focused on cycles and momentum Nenner sees a cyclical low coming in the next few days

"People looking for major moves are going to be disappointed," he says. Timing and trading are key as he thinks stocks are going to be locked into a 5-10% range for an extended period.

Bonds

"First people lost their shirts on the stock market then the gold market." says Nenner. "I'm afraid that now they're going to lose a lot of money on their bond positions."

Of course people have been taking the other side of the bond bet for the better part of three decades, only to see yields drop to previously unthinkable lows.

Gold

Those unfortunate souls who lost their shirts on gold buying it at $1,900 may ultimately get bailed out by the markets but not before getting hung out to dry for a little while longer.

With Stocks Down and Yields Low, Is it Time to Buy Junk Bonds?

At a glance you can plainly see if the ocean is at high tide or low tide, and yet it's virtually impossible to detect exactly when the tide is changing until long after it has actually happened.

In much the same manner, the junk bond market looks to be undergoing a major tide change of its own, having just snapped a six-month string of withdrawals. If the tide has actually turned, then the $1.2 billion of new money that poured into high yield funds last week could be the start of a bigger trend.

In fact, over the past three months, when the S&P 500 has shed about 8%, the junk indexes are down less then 2%, and that doesn't include dividend yields of 7% t0 7.5%. It's also worth noting that within this universe Levine says the ratings agencies ''do a good job" and are still powerful—even respected, in as much as they bring order to the system and create opportunities.

Wealthy Swiss Hoard Cash, See Doom for Euro

If you want proof that the world's wealthy are worried, consider this: Swiss banking clients have nearly a third of their portfolio in cash. And one in five believe the Euro will collapse.

The findings are included in a new report from LGT Group, the Austrian banking company, conducted with Austria's Johannes Kepler University. The study found that wealthy Swiss and Austrian private-banking clients remain highly risk-averse and fearful of inflation, sovereign debt defaults and the unstable financial system.

"Private banking clients are still being influenced in their behavior by the turmoil in the financial markets and it appears increasingly likely that this will remain the case for this generation of clients for a long time yet," according to the report.

Market manipulators have not been able to trigger panic selling despite bearish market sentiment. Market participants do not have much confidence in equity stocks but are not willing to dump the core holding stocks in the portfolio. Therefore trading volume comes mainly from day traders.

As market manipulators are no longer short selling stocks, market participants are less worry of market collapse and begin to pick bargains during pullback. The outlook for wealth assets in the second half year is positive since capital are flowing from low yield money market to riskier assets.

4 Catalysts to Spark an S&P 500 Rally to 1,500

Jim Paulsen, chief investment strategist at Wells Capital Management, is sticking by his year-end target of 1,500 on the S&P 500. He's zeroing in on four main catalysts that could spark a rally in the second-half of the year.

First up is Europe. Yes, Europe. Despite the market selling off on the latest round of concerns that nothing will emerge from another European Summit at the end of this week, Paulsen says we've seen this before and it's simply not the crisis it was once considered. He calls it more of a "chronic problem" that will be with us for the next decade, rather than a full-blown imminent threat.

"We've seen how this works out, the Euro fears flare, the market sells off, then they calm down and we go on to new highs," he says. "So rather than Europe fears flaring as a sell signal, I think what it has represented for the last two years is a good buying opportunity."

Second, Paulsen is as bullish on the U.S. economy as it gets these days. In his view, investors are too focused on China and Europe, and overlooking underlying strengths domestically. While overseas economies matter, he believes this year's U.S. growth data has been overstated, understated, and is now balancing out at about 2.5%.

Third, Paulsen points to emerging market economies.

"To me the biggest risk we face is not Europe, it's a recession in the emerging world. If that happens I think the global recovery is over," he states.

But Paulsen sees this as a low probability risk due to accommodative policy measures taken last Fall that will ultimately fuel those key economies to higher growth levels. He believes we'll see evidence of China's slowdown bottoming by the start of the fourth-quarter.

Finally, Paulsen points to earnings multiples. In his latest research note he cities the following:

Trailing 12-month earnings per share are now about $100. Therefore, the price-earnings multiple (PE) on trailing earnings is now slightly less than 13 times and the PE based on year-end consensus estimated earnings is currently less than 12.3 times.

"I think it's cheap," states Paulsen confidently. "We've never in the post-War era had this low of multiples when interest rates and inflation were also this low."

'Check Engine' Light for US Economic Driver Is On

If small business is the economic engine that makes America go, then it's clear the "check engine" light is now on.

New data from the small business analytics firm PayNet shows investments by small manufacturers slowed down substantially in the first quarter. Even more worrisome, those business owners are cautious about growth in the second half of this year. "It's surprising. It's a cooling off," says William Phelan, PayNet's co-founder and president. "If you see the relative changes going on here you can say they really have become more cautious and started to jam on the brakes."

If small business is the economic engine that makes America go, then it's clear the "check engine" light is now on.

New data from the small business analytics firm PayNet shows investments by small manufacturers slowed down substantially in the first quarter. Even more worrisome, those business owners are cautious about growth in the second half of this year. "It's surprising. It's a cooling off," says William Phelan, PayNet's co-founder and president. "If you see the relative changes going on here you can say they really have become more cautious and started to jam on the brakes."

Stocks to Bottom This Week: Charles Nenner

With stocks bonds and gold careening between hope and greed every few days Nenner updated his views and price targets for each of the Big Three.

Stocks

Having been true to his word and taken money off the table in stocks 3 months ago, Nenner is looking to start getting long again this week. Focused on cycles and momentum Nenner sees a cyclical low coming in the next few days

"People looking for major moves are going to be disappointed," he says. Timing and trading are key as he thinks stocks are going to be locked into a 5-10% range for an extended period.

Bonds

"First people lost their shirts on the stock market then the gold market." says Nenner. "I'm afraid that now they're going to lose a lot of money on their bond positions."

Of course people have been taking the other side of the bond bet for the better part of three decades, only to see yields drop to previously unthinkable lows.

Gold

Those unfortunate souls who lost their shirts on gold buying it at $1,900 may ultimately get bailed out by the markets but not before getting hung out to dry for a little while longer.

With Stocks Down and Yields Low, Is it Time to Buy Junk Bonds?

At a glance you can plainly see if the ocean is at high tide or low tide, and yet it's virtually impossible to detect exactly when the tide is changing until long after it has actually happened.

In much the same manner, the junk bond market looks to be undergoing a major tide change of its own, having just snapped a six-month string of withdrawals. If the tide has actually turned, then the $1.2 billion of new money that poured into high yield funds last week could be the start of a bigger trend.

In fact, over the past three months, when the S&P 500 has shed about 8%, the junk indexes are down less then 2%, and that doesn't include dividend yields of 7% t0 7.5%. It's also worth noting that within this universe Levine says the ratings agencies ''do a good job" and are still powerful—even respected, in as much as they bring order to the system and create opportunities.

Wealthy Swiss Hoard Cash, See Doom for Euro

If you want proof that the world's wealthy are worried, consider this: Swiss banking clients have nearly a third of their portfolio in cash. And one in five believe the Euro will collapse.

The findings are included in a new report from LGT Group, the Austrian banking company, conducted with Austria's Johannes Kepler University. The study found that wealthy Swiss and Austrian private-banking clients remain highly risk-averse and fearful of inflation, sovereign debt defaults and the unstable financial system.

"Private banking clients are still being influenced in their behavior by the turmoil in the financial markets and it appears increasingly likely that this will remain the case for this generation of clients for a long time yet," according to the report.

Thursday, June 28, 2012

泛藍麥業成等成員及李偉儀退出人民力量

公告

2012-06-28

人民力量內部變動

就香港泛藍決定於今日(六月二十八日)退出人民力量,同時香港泛藍成員麥業成、謝義方、韋復家、陳惠玲及林偉棠亦會退出人民力量執委會,已獲本會備悉。本會對香港泛藍的決定,深感婉惜和遺憾。

人民力量與香港泛藍都是民主路上的同路人,彼此不存芥蒂。本會期待在未來的日子裡,雙方在互相勉勵的基礎上,繼續攜手推動民主發展,捍衛香港法治。

本會衷心感謝香港泛藍各執委成員一直以來對人民力量的付出,特別是副主席麥業成議員由創立人民力量以來,對本會的無私貢獻。

人民力量執委會 謹啟

二零一二年六月二十八日

普羅政治學苑黃議員毓民大鑑:

李偉儀宣佈即日(28日)退出人民力量。本人於2011年經由普羅政治學苑推薦加盟人民力量,所以於早前已親自與黃毓民議員面談商討此重大退會決定和事件因由,獲黃毓民議員明白和批准,現特函確認。

晚自1991年踏入學運和社運圈,因社會運動和報章寫作而認識毓民十多年。與毓民正式相交八載,緊隨毓民和一群志同道合者抵手拼足開拓本土反對派政黨政治,毓民才情橫溢,思維敏捷幽默,作風不拘小節,行事包容,對事不對人。最重要是毓民濟弱扶傾義無反顧、無懼政權打壓之情操深深打動眾多支持者,亦成為晚輩學習的榜樣。

自始參政、社運、學術連成鐵三角,互譜益發,啟發本人之人生路向。衷心感激毓民一直對本人的照顧和鼓勵,以兄妹親情相待情深義重,更於本年三四月份邀本人再度於九西合組一條名單,此情此德,銘感於心。

惟本人以信義為本,以政品為從政原則,恪守協助麥業成兄和香港泛藍之約而推卻毓民之美意,寧⋯⋯可雪中送炭,不作錦上添花。毓民遂表示支持本人繼續全力投入協助麥業成兄打拼及寄望新西雙嬴。毓民與晚之良好合作將一直延續,拉布戰役與陳冉司法覆核案為近期攜手作戰之例。

本人已向多方解釋協助麥業成兄之約定始於2010年陳偉業兄親約麥業成兄和本人共同會面,席上告之決定於來屆退下立會火線並邀麥業成兄繼往開來承擔民主重任,及希望本人能動員樁腳積極協助麥業成兄。故自當刻開始,本人與麥業成兄緊密合作,兩年多來之部署亦獲認受。今日純為組織旗幟變動,麥業成兄不忍陳偉業議員備受壓力影響選情,心痛取捨,本人亦為免背負人民力量身份引起組織尷尬而決定同時離開,唯有在十星期倒數之時暫別毓民。

保皇當道,反對派絕對沒有分裂的本錢,此決定非關組織分裂,望支持者和旁人尊重麥業成議員、香港泛藍及本人之決定,莫出惡聲,何況是次只為旗幟變動,不涉君子交絕或任何政治立場改變。

晚深信殊途同歸,造福人民的使命感一路走來始終如一,那末政治生命之延展和深厚情誼之磐石深種,即不會因組織形式聚散而斷絕關係,望我們於政治路上儘快重逢,開拓普羅教育實踐及進而壯大反對派民主政治。在此祝願毓民成功連任,身體健康,家庭幸福。

晚李偉儀敬上

2012年06月28日

(副本:致人民力量黨團及執行委員會及各大傳媒)

Friday, June 22, 2012

「梁振英當選 香港危急存亡」 蕭若元參選 抗威權政府 (原載《am730》)

(2012年06月22日)

【am專訪】還有9天,香港正式進入梁振英時代,有人喜迎新時代,亦有人誠惶誠恐,憂怕從今失去免於恐懼的自由。向來以嚴詞斥責庸官劣政的「才子」蕭若元,在這關鍵時刻決意轉換崗位,毅然披甲出戰立法會選舉,更將親手創立的「香港人網」存亡押在今次選舉,他接受本報專訪時形容,梁振英當選令香港處於危急存亡之秋,必須爭取更多議席,並集結群眾力量來對抗威權政府。

夥人民力量名單戰港島

近期一直被友好及支持者游說出選的香港人網創辦人蕭若元,日前接受本報專訪時,劈頭便明確決志:「我係會出嚟參選!」他將夥拍人民力量主席劉嘉鴻及成員歐陽英傑,以一條名單出戰港島區。

向來不群不黨、亦沒有公職在身的蕭若元,十多年來一直扮演評論者角色,因為梁振振英而決志披上戰衣,「開始考慮參選,因為梁振英當選」,他形容這是香港危急存亡之秋,而他眼中的梁振英,只是中聯辦傀儡,「中聯辦治港,破壞港人治港、一國兩制,咁情形下你唔抵抗,香港會變咗大陸……」

憂失去免於恐嚇的自由

最令他擔憂的是,香港會失去最令人珍而重之的核心價值,蕭若元從無放洋留學,亦無趕89年的移民潮,因喜歡香港的生活,他所指的香港生活形式,是一定要有免於恐嚇的自由,「即係我得罪李嘉誠、我得罪曾蔭權,我唔會驚報復,大家相唔相信以後唔會有報復?」他訴說「秋前算帳」的例子,「唐營嘅人幾多俾石頭掟中咗,歐文龍案牽涉200笪地,有5笪被收回,就係大劉(劉鑾雄)5笪。」

不少人對梁振英心存恐懼,曾與他做鄰居的蕭若元說,「佢同佢班支持者一向認為,法官唔應該違背行政主導判案,唔應該有司法覆核……所有嘢變成行政附庸,政治凌駕於所有考慮之上……」

曾公開宣示若人民力量在來屆選舉未能取得3席,便關閉香港人網的蕭若元說,盡力爭取立法會議席,是要在議會內外發聲來抵抗權力被侵蝕。蕭若元服膺於甘地、哈維爾、馬丁路德金的思維,即非暴力積極反抗者,「議會只係platform(平台)俾人發聲,仲要另外組織群眾。」他指一個威權政府是建立在人民對其容忍之上,「呢個係哈維爾所講:『無權力者之權力』……我唔需要用武力同佢對抗,我不停俾壓力你,增加你嘅交易成本。」

冀憑知名度送劉嘉鴻入議會

對於與人民力量的關係,蕭若元指一直支持反抗力量,但一定不會加入人民力量,會以獨立身份參選,名單排位則待人民力量執委會決定。他不諱言希望憑個人知名度,力送劉嘉鴻晉身議會,「(人民力量)主席入到係最重要嘅,有咗呢個status(身份),先至有地位可以繼續領導反抗力量。」他又說,「你唔送多啲後生仔入立法會,過4年抗爭道統就會中斷,因為毓民同大嚿(陳偉業)唔再選,係咪全部都變晒呢個政府嘅馴服工具?」

現年63歲的蕭若元,自97年至今曾四度入深切治療部,他坦言家人因擔心其身體狀況,曾極力反對他參選,但他指必須身體力行,才能鼓動支持者多行一步,「如果我唔做,最後真係輸咗,我會後侮,唔能夠原諒自己!」至於贏取議席的機會,他指難言選舉結果,但估計人網及人民力量在港島有2萬票基本盤,與至少需3萬票取得1席的距離不遠,他希望藉知名度及選舉工程,爭取更多支持票。人民力量將於周日在銅鑼灣行人專用區舉行「決志港島」誓師活動,估計將有約3千人出席,他形容,「要令港島所有黨派聞風喪膽」。

文:鄭秀韻 圖:梁靖鏘

【蘋果動新聞】龍心拎住碌蔗 TVB 等女

言行皆出位的「維園霆鋒」龍心,近日獲邀做 online game 代言人,他以多個 chok 爆造型示人。龍心前晚還企圖拿着兩碌蔗硬闖無綫,希望覓得美女返歸陪打機,可惜最終無癮食白果而回。

Investors Take Profit After Rebound

After a strong rebound in the previous week, market encounters selling pressure as market participants take profit on earlier bargain buys. Smart investors seem to have learned the trick to buy low and sell high in a range bounded market. Market manipulators remain skeptical on market outlook as household investors are extremely cautious on equities and only allocate small portion of the portfolio in stocks. But as individual investors are no longer dumping stocks, short selling from market manipulators would not drive the herd into panic selling.

Traders have plenty of unfavorable news to drag down market. However, stock holders are not willing to sell at beaten down price. Therefore although market wavers on news, trading activity remains low. Smart traders find opportunity in swing trading while investors remain sitting on existing portfolio with limited stock exposure and large amount of cash without significant buying or selling.

Market manipulators are using news to weight down market for the bearish positions. But making profit is not as easy as in last year because market participants have paid heavy cost to learn the trick and will not make similar mistake again by staying on the sideline. However, speculators can use this opportunity to make profit in market cycles. When market drops to bottom, buy at a bargain with cash while other market participants are fear of market collapse. When market rallies, take profit and use the cash to wait for another buying opportunity while traders and market manipulators start selling.

The Big Conundrum: Stocks or Bonds?

As the sovereign debt debacle in Europe slogs along, and with the global economic recovery seemingly stalled out, investors and analysts are sizing up a drastically reshaped global landscape.

In this increasingly volatile market, some see stocks as having much better prospects than bonds, assuming Europe rights itself and the economic recovery finally takes off. Others believe the three-decade bull market for bonds still has legs.

A lot may depend on your inflation outlook - but bonds, particularly Treasurys, have performed so well for so long, it's hard to think fixed income is the horse to ride. At the same time, stocks have been full of disappointment lately, and investors are much more risk-conscious today.

Indeed, investors today remain confused because although stocks look attractively valued for the long term, their emotions are whipsawed by almost daily fluctuations in the global equity markets and constant reminders that another Lehman-like catastrophe could be brewing in Europe. At the same time, they are being advised by bond experts that Treasury bonds are likely the next bubble.

"Stocks are very cheap," adds Charles Rotblut, editor of the AAII (American Association of Individual Investors) Journal. "But we are facing a situation where things could go right or they could go wrong. So, while stocks look very attractive over the long-term, there are issues that could hurt their short-term returns."

At the same time he warns investors to be judicious because except for Treasury bonds, most other fixed-income assets have been moving in tandem with the equity markets, diminishing their diversification benefits.

Net Worth Implosion: It's Not Just Housing

New Census Bureau data shows that median household net worth, excluding home equity, fell by 25% between 2005 and 2010. That decline was driven largely by the plummeting stock market, which devastated Americans' portfolios and retirement accounts.

"One of the significant factors is housing, of course, but it's not that alone" said Alfred Gottschalck, an economist with the Census Bureau. "It's how business conditions affect stock and retirement accounts."

Forget Summer Swoon, This Is A Buying Opportunity: Wilkinson

With the price of safety, as measured by demand for the 10-year Treasury, trading near an all time high, it is fair to say that the price of risk, as measured by the S&P 500, is comparably cheap right now. Put another way, to some investors, there's nothing but downside for debt and nothing but upside for stocks.

To be fair, this is not to say that markets won't continue to be risky, volatile and frustrating, but rather, that over time, look set to deliver superior returns especially if you believe they'll be guided by the Fed.

US Stocks Cheap? 'You're Wrong': Grantham

Considered one of the finest investors of his generation, GMO co-founder Jeremy Grantham is known best for his bearish views on U.S. equities. At the Morningstar Investment Conference on Friday, he's upholding that reputation. Outside of the U.S., however, his views are much more bullish.

"Equities are boring; bonds are disgusting," said Grantham. "It's a difficult environment to operate in."

Grantham thinks US corporate earnings are "abnormally high," for two main reasons: He sees profit margins trending up as government debt increases - "this is an artificial prop to the market" - and an overly bullish bias because being bearish is "bad for business."

In particular, Grantham cites energy, metals and food - limited resources sure to be stretched by China's rapidly growing demand - as opportunities for the internationally minded investor.

"We live on a finite planet," he said. "We have finite resources, and we're running out of good arable land."

Traders have plenty of unfavorable news to drag down market. However, stock holders are not willing to sell at beaten down price. Therefore although market wavers on news, trading activity remains low. Smart traders find opportunity in swing trading while investors remain sitting on existing portfolio with limited stock exposure and large amount of cash without significant buying or selling.

Market manipulators are using news to weight down market for the bearish positions. But making profit is not as easy as in last year because market participants have paid heavy cost to learn the trick and will not make similar mistake again by staying on the sideline. However, speculators can use this opportunity to make profit in market cycles. When market drops to bottom, buy at a bargain with cash while other market participants are fear of market collapse. When market rallies, take profit and use the cash to wait for another buying opportunity while traders and market manipulators start selling.

The Big Conundrum: Stocks or Bonds?

As the sovereign debt debacle in Europe slogs along, and with the global economic recovery seemingly stalled out, investors and analysts are sizing up a drastically reshaped global landscape.

In this increasingly volatile market, some see stocks as having much better prospects than bonds, assuming Europe rights itself and the economic recovery finally takes off. Others believe the three-decade bull market for bonds still has legs.

A lot may depend on your inflation outlook - but bonds, particularly Treasurys, have performed so well for so long, it's hard to think fixed income is the horse to ride. At the same time, stocks have been full of disappointment lately, and investors are much more risk-conscious today.

Indeed, investors today remain confused because although stocks look attractively valued for the long term, their emotions are whipsawed by almost daily fluctuations in the global equity markets and constant reminders that another Lehman-like catastrophe could be brewing in Europe. At the same time, they are being advised by bond experts that Treasury bonds are likely the next bubble.

"Stocks are very cheap," adds Charles Rotblut, editor of the AAII (American Association of Individual Investors) Journal. "But we are facing a situation where things could go right or they could go wrong. So, while stocks look very attractive over the long-term, there are issues that could hurt their short-term returns."

At the same time he warns investors to be judicious because except for Treasury bonds, most other fixed-income assets have been moving in tandem with the equity markets, diminishing their diversification benefits.

Net Worth Implosion: It's Not Just Housing

New Census Bureau data shows that median household net worth, excluding home equity, fell by 25% between 2005 and 2010. That decline was driven largely by the plummeting stock market, which devastated Americans' portfolios and retirement accounts.

"One of the significant factors is housing, of course, but it's not that alone" said Alfred Gottschalck, an economist with the Census Bureau. "It's how business conditions affect stock and retirement accounts."

Forget Summer Swoon, This Is A Buying Opportunity: Wilkinson

With the price of safety, as measured by demand for the 10-year Treasury, trading near an all time high, it is fair to say that the price of risk, as measured by the S&P 500, is comparably cheap right now. Put another way, to some investors, there's nothing but downside for debt and nothing but upside for stocks.

To be fair, this is not to say that markets won't continue to be risky, volatile and frustrating, but rather, that over time, look set to deliver superior returns especially if you believe they'll be guided by the Fed.

US Stocks Cheap? 'You're Wrong': Grantham

Considered one of the finest investors of his generation, GMO co-founder Jeremy Grantham is known best for his bearish views on U.S. equities. At the Morningstar Investment Conference on Friday, he's upholding that reputation. Outside of the U.S., however, his views are much more bullish.

"Equities are boring; bonds are disgusting," said Grantham. "It's a difficult environment to operate in."

Grantham thinks US corporate earnings are "abnormally high," for two main reasons: He sees profit margins trending up as government debt increases - "this is an artificial prop to the market" - and an overly bullish bias because being bearish is "bad for business."

In particular, Grantham cites energy, metals and food - limited resources sure to be stretched by China's rapidly growing demand - as opportunities for the internationally minded investor.

"We live on a finite planet," he said. "We have finite resources, and we're running out of good arable land."

Sunday, June 17, 2012

IFPI welcomes closure of unlicensed music forum Fdzone.org

The IFPI has welcomed the closure of Fdzone.org (also known as P2PZone), an unlicensed music forum which is believed to have gained its operators $1.5 million in profits.

The forum, which was shut down by Macau and Hong Kong customs officials, had been running since 2003 and had amassed almost 900,000 users.

Officers from the Macau Customs Service and Hong Kong Customs and Excise Department raided premises associated with Fdzone on June 7, following a complaint from IFPI.

The suspected operator of the service was arrested, along with three other people who are believed to have handled illegal proceeds generated by the forum. Customs officials also seized computers, servers, cash, credit cards and documentation in the raids.

It’s alleged that the site made substantial revenues from subscription and advertising but the site's operator is believed to have begun charging users for access from 2009.

The fee was recently increased, despite the implementation of the newly-revised copyright law in Macau that toughened penalties on those making a profit from copyright infringement. The operator is also believed to have made around US$650 daily from advertising fees.

The unlicensed forum contained thousands of infringing links to Chinese, Japanese, Korean and Western repertoire. Some of these links were to files containing large compilations of work by different artists.

“We are delighted that Macau and Hong Kong Customs officials have acted promptly on our complaints and taken action to close this lucrative unlicensed business down,” said regional director of IFPI Asia Leong Mayseey.

“Copyright-infringing sites such as FDZone.org are a huge problem for legal music services in the region which offer consumers a great service while respecting artists and songwriters. Actions such as these are great help in boosting that legitimate business.”

The forum, which was shut down by Macau and Hong Kong customs officials, had been running since 2003 and had amassed almost 900,000 users.

Officers from the Macau Customs Service and Hong Kong Customs and Excise Department raided premises associated with Fdzone on June 7, following a complaint from IFPI.

The suspected operator of the service was arrested, along with three other people who are believed to have handled illegal proceeds generated by the forum. Customs officials also seized computers, servers, cash, credit cards and documentation in the raids.

It’s alleged that the site made substantial revenues from subscription and advertising but the site's operator is believed to have begun charging users for access from 2009.

The fee was recently increased, despite the implementation of the newly-revised copyright law in Macau that toughened penalties on those making a profit from copyright infringement. The operator is also believed to have made around US$650 daily from advertising fees.

The unlicensed forum contained thousands of infringing links to Chinese, Japanese, Korean and Western repertoire. Some of these links were to files containing large compilations of work by different artists.

“We are delighted that Macau and Hong Kong Customs officials have acted promptly on our complaints and taken action to close this lucrative unlicensed business down,” said regional director of IFPI Asia Leong Mayseey.

“Copyright-infringing sites such as FDZone.org are a huge problem for legal music services in the region which offer consumers a great service while respecting artists and songwriters. Actions such as these are great help in boosting that legitimate business.”

少林博士第一人 科學說氣功 (原載《明報》)

梁恩貴博士--研究中國古代人體能量科學,法號釋德龍,少林寺三十一代弟子(陳淑安攝)

【明報專訊】氣功養生,玄妙至極,太過形而上,欠缺科學根據,不為現代人所喜。

我們總需要過多的數據和報告去支撐理智,才願意做對身體好的事。

梁恩貴博士研究行氣導引術,卡片上書「中國古代人體能量科學」,兩本論文厚疊疊13萬字,他用了7年時間,以科學研究精神,鑽探中國遠古智慧,嘗試扭轉行外甚至是行內人對氣功的不求甚解。

當他以三個名詞頭頭是道地解釋天地人的關係,氣功變得不再神秘。

巫術?武術?醫術?他一直尋找着老祖宗們留下的道。

若你觀賞過梁恩貴治療病人的錄像後,依然不相信病人們的怒吼和抽搐是真有其事,不要緊,建議你親身見他一面,你對氣功的疑心將被動搖。

梁博士今年60歲,外表卻似40多,大手握下厚實有力,聲音洪亮,表演內家功力時肩膊往外拉,脊椎竟然咯咯作響;示範吐納時,其呼吸聲更是遠遠也聽得見,他分享以下經歷﹕「有次我弄傷手流血,望着鮮血逕自傻笑,老婆說我神經病,流血都那麼開心,因為我見到自己的血,鮮紅鮮紅的,極之健康。」他肯定,對面這位比他年輕一倍的記者的血的顏色,必然較他暗黑得多。

苦等20年 終成少林弟子

敢情是,記者好日不運動,梁博士10歲便開始練武。他母親是粵劇演員銀劍影,舅父是導演龍圖,之所以他﹕「細細個擘大眼,便見一班粵劇演員練功,開始接觸武術,四處拜師四處玩。」循道中學畢業後,他遠赴英國念環境設計,回港執業,可惜外國太太不習慣香港生活,回流英國。但在白皮膚人的世界,所學並無用武之地,索性就以武為業,開班授徒。梁博士對武術的熱愛,使他於1980年代,嵩山少林寺開放時,立即前往學武,結識同道中人,更不時順路到陳家溝偷師,回港時亦都向各路師傅請教,邊練邊教。接觸氣功,是2000年正式成為少林入室弟子之後的事。

「我初初水平差,像很多人一樣不太清楚內功,有說是陰力、內力,但講來講去都解釋不到是什麼,等了20年,師父素喜才正式收我做弟子,有機會學內家拳,如少林柔拳、羅漢拳、易筋經、八段錦,對內家拳算有少少認識。」因為練拳,他的氣場加猛,發現自己的氣能引發第三者的反應,所謂內氣外發,他開始替人治病。「我有很多成功例子,如治癌、戒毒、心理病等,西歐國家的大學教授或西醫覺得奇怪,這名中國佬不用藥不用針,光是郁動雙手就將明明無得救的病人醫好,開始請我去講座。」但問題來了,站在百多二百名醫生、物理治療師、心理醫生前面,被人發問時,梁博士口啞啞,深切體會到自己學識不夠。他到山東大學進修,開始重新由道學入手,研究氣功,將之理論化,博士論文題目是「行氣導引術」,是少林第一個博士。

傳統智慧 釋放人體能量

這不是中國獨有鬼,梁博士解釋﹕「全世界都有人體能量的practice,像南美洲、印度,以前的戰士打仗前會做某些儀式,刺激身體,變成great warriors。」他給予自己的研究這個名稱——中國古代人體能量科學,就是要以科學精神,借助解剖學、神經系統、人體結構、血液系統等種種生理心理知識,配合中醫所講的內氣、經絡研究,探求中國民族文化經過時間考驗流傳下來的智慧,釐清種種誤解﹕「『能量』之於中國人,就是外氣、內氣。『人體』要鍛煉,除了外功,也有內功,才能吸收宇宙能量。我們所講究的天人感應,看似玄妙,其實就似是皮膚若不曬太陽的話,會欠缺維他命D一樣的道理,外氣(太陽)對細胞產生影響。」所以這不但與迷信無關,更是種科學。

梁博士研究的重點,是以三個關鍵詞分析氣功如何透過三個層次,達到「有病醫病,無病養生」的目的。

文 饒雙宜

圖 陳淑安、受訪者提供

編輯 方曉盈、陳嘉文

Saturday, June 16, 2012

【蘋果動新聞】龍心晒 J 借警兇牛佬

繼上人網抽仙樂都水同涉嫌六四集會時 喺 阿夢岑寶兒面前自瀆後,「維園霆鋒」龍心(定係絕心)人氣幾何級數上升,唔知係真癲定假癲 嘅 佢,日日例行拎住佢部 focus 唔到 嘅 Sony 上街拍片,睇 吓 拍唔拍到正 嘢 放上 YouTube ,俾班信眾 喺 電腦前自 high 頂癮。

前日龍心殺到去旺角,估唔到又有收穫。當日佢見到有皇氣,即時當街叫囂:「邊個係黑社會,全部同我『響朵』!」之後又話:「旺角我 揸 旗, do you understand ?」唔知係咪呢句辣 㷫 咗 班 MK 友,突然有個自稱「牛佬」 嘅 大隻佬殺出,作狀自摸下體 嚟 問龍心:「係咪咁 揸 旗?」走 嗰 陣又向龍心舉中指,搞到俾龍心寸:「走住 嚟 X ,冇 X 用!」

Friday, June 15, 2012

Market Moved By Speculation And Hot Money

Market has strong support after reaching bottom predicted in the previous week. As mentioned in earlier post, there is tremendous amount of money looking for bargain in equity stock market. Liquidity in capital market creates turbulence. But on the other hand, fear of market collapse makes investors hesitate. Traders and market manipulators use Euro zone crisis to beat down market and market participants are reluctant to buy although market valuation is attractive.

Speculators find opportunity in swing trading as low valuation attracts buyers but market fear encourages profit taking. The conflicting factors, in addition of hot money, creates turbulence in equity stock market. The currency and commodities market are also affected as hot capital is looking for investment return. Bond market is safe heaven in short or long term aspect. Liquidity in capital market is tremendous but only small fraction is driving the real economy through lending to facilitate business operation.

Market should remain range bounded as market participants are still very cautious. After the strong rebound, many investors will realize profit and wait for another opportunity. Smart traders and market manipulators have already taken profit when market hovers near bottom. There is not yet sign of turning optimistic. There are still many uncertainties and coming news to drag down market. Overall participation in market activities remains low among household investors. Hedge funds are gradually accumulating stocks due to net inflow of capital and attractive market valuation.

Goldman Sees a 29% Return From Commodities Over 12 Months

Goldman Sachs Group Inc. said it expects a 29 percent return from the Standard & Poor's GSCI Enhanced Commodity Index over the next 12 months, with the biggest gains in energy and base metals.

Policymakers in Europe will be able to contain the continent's debt crisis, while recovery in the U.S. and China is set to continue, Jeffrey Currie, head of commodities research in New York, said today in a report. Returns on energy investments may be 41 percent in 12 months, compared with 23 percent in base metals and 18 percent in precious metals, while agriculture is forecast to lose 14 percent in the period, according to the report.

"Although the macroeconomic backdrop still remains uncertain, particularly in Europe, we believe that the sell-off in commodity prices is likely overdone and the price risks are shifting more to the upside," Currie wrote.

Bond Bubble Dismissed as Low Yields Echo Pimco's New Normal

Mohamed El-Erian knows why bond markets from the U.S. to Germany to Brazil, where yields have dropped to record lows even though debt has ballooned to more than $40 trillion worldwide, aren't a bubble waiting to burst.

The average yield on bonds issued by the Group of Seven nations has fallen to 1.120 percent from 3 percent in 2007, Bank of America Merrill Lynch index data show. Germany's two-year note yield fell below zero for the first time on June 1, while Switzerland's has been negative since April 24, meaning investors are paying for the right to lend the nation money.

Yields on government securities in the U.S., Germany, the U.K., Austria, the Netherlands, Finland and Australia tumbled to all-time lows this month as Europe's debt crisis intensified, manufacturing worldwide slowed and unemployment in the U.S. unexpectedly rose.

"You're not talking about a bubble because a bubble is about greed," Jeffrey Rosenberg, chief investment strategist for fixed income at BlackRock Inc. in New York, which has $3.68 trillion under management, said in a June 6 telephone interview. "That's not a reflection of ‘I expect prices to go higher and I have to jump in,' that's a reflection of ‘I want to preserve my principal.' Negative yields reflect fear."

Pimco officials point to Japan, which has been in and out of recession since the mid-1990s, as what the new normal would look like. Even though it has the world's largest debt load at more than $11 trillion, Japan has some of the world's lowest bond yields because of years of below-average growth.

"In many ways, we are replicating the Japanese experience," George Magnus, senior economic adviser in London at UBS AG, said in a June 5 telephone interview. "Banks and households have become overextended, and now we know governments have also become overextended. The problem is that the deleveraging means people are saving more. There is no sufficient spending and lending to boost the economy."

Central banks, including the Fed, ECB and Bank of Japan, have helped soak up the extra supply as policy makers injected money into their economies by purchasing government securities. The balance sheets of the world's six biggest central banks have more than doubled since 2006 to $13.2 trillion, according to Chicago-based Bianco Research LLC.

"Yields are extremely low for a very good reason, and that's fear," Stuart Thomson, a money manager at Ignis Asset Management in Glasgow, which oversees about $115 billion, said in an interview on June 1. "I don't see us heading into a bear market."

Citizenship for sale: Foreign investors flock to U.S.

Facebook co-founder Eduardo Saverin drew public ire last month following the revelation that he had renounced his U.S. citizenship, a move widely seen as a tax dodge. But thousands of wealthy foreigners are lining up to replace him, making investments here and putting themselves on a path to citizenship in the process.

The State Department expects to issue over 6,000 "investor visas" in the current fiscal year, which would be an all-time record. Other countries, meanwhile, are following the U.S.'s lead, keen to spur growth in lean economic times.

Under the government's EB-5 Immigrant Investor program, foreign investors can get conditional visas that allow them and their families to live, work and attend school in the U.S. To qualify for the visa, they must invest at least $1 million in a new or recently created business, or $500,000 for businesses in rural or high-unemployment areas.

Demand shows no sign of slowing down, either. International travel, banking and communication have become increasingly easy, while Asia, in particular, is minting new millionaires at a rapid pace.

Foreign holdings of US debt hit record high

Foreign demand for U.S. Treasury securities rose to a record high in April. China, the largest buyer of Treasury debt, increased its holdings slightly after trimming them for two straight months.

Demand for Treasury securities has remained strong despite the first-ever downgrade of the government's debt last August. Standard & Poor's lowered its rating on long-term Treasury debt one notch from AAA to AA+ following a prolonged debate in Congress over increasing the nation's borrowing limit.

Last week, S&P reaffirmed that rating and said it was keeping a negative outlook on the rating for the future.

Is High Frequency Trading Ruining the Market?

High-frequency trading (HFT) is a market-skewing, artificial form of speculation that places undo pressure on already fragile markets, which, by doing so, increases the risk of another flash crash or something much worse. HFT accounts for over 50% of all trading volumes, further distancing individual investors from the market and eliminating virtually any link between valuation and market price.

These trades are all based on picking up the next penny of a stock's move. The programs look for any indication of direction—be it order imbalance, momentum tells, or whatever else can be jammed into an algorithm—and jumps in front of the trade. The goal is to buy a few thousand shares ahead of a tiny move, and then sell when the move arrives. Repeat the process millions of times a year and it adds up to real profits for HFT firms.

The high-frequency trades run amok because there is no longer a market maker (read: human) in the middle of the trading process. The function of matching every buyer with a seller is fully automated, eliminating what Saluzzi calls a "shock absorber" for stocks. As a result, too many program trades can create vacuums where prices lurch beyond where they otherwise might be, as the HFT merrily picks off market orders made by actual people.

Contrarian Investing? Forget About It, Cramer Says

In the investment world, a contrarian is someone who takes a position that differs from the majority. If a particular sector is "hated" by most investors, a contrarian might want to buy in. After all, if few investors like the sector, a contrarian thinks there are few people left to sell, making it immune to big declines.

Cramer noted many industrial managers said things were weaker than people thought thanks to fears over Europe's ongoing debt crisis, which means they didn't meet their earnings estimates. Upon hearing this, the few investors who owned industrials sold their shares. The industrial stocks got hammered.

So even the contrarians think that Europe's economy is only getting worse and they couldn't take the pain, Cramer said, despite the fact they thought their contrarian trade would have been immunized against it.

It's Do or Die for U.S. Stocks

With major indexes rallying back to important short-term price ceilings, the stage is set for what may become the stock market's biggest collective decision of the summer.

Whether it is confirmation by Fed Chairman Ben Bernanke that he will print more money or the pending elections in Greece, the news should spark a technical breakout or breakdown, respectively.

10 Reasons to Be a Bull, From a Stock Market Bear

Finding reasons not to like the current stock market doesn't take much work, as the faltering U.S. economy, European debt crisis and looming fiscal cliff makes the job pretty easy.

But devising a list to be bullish - after one dismisses the usual "stocks are cheap" and "best house in a bad neighborhood" platitudes - takes some work, especially if your natural inclination is that the market is heading lower.

The list:

•10. Corporations are managing risk and doing more with less. Yes, a form of the "stocks are cheap" argument, but with acknowledgement that a pullback in earnings would still leave companies in solid shape profit-wise.

•9. Consumer confidence is still high. Friday's numbers indicated that consumer sentiment is beginning to wane, but remains strong.

•8. Gas prices are trending lower. Sure, $3.52 a gallon is still high, but it's 20 cents lower than last month.

•7. Forget Facebook, the capital markets are still open "if highly selective." The social network's initial public offering was a flop, but other deals, including Thursday's Felda Global Ventures $3.1 billion IPO, are raising cash.

•6. Mortgage rates still falling. Home borrowing rates at record lows are dragging the industry off its bottom.

•5. Mom-and-pop investors are making money, but with bonds. While we've been bemoaning all those fund flows out of equities and into fixed income, it's worked out well for the retail crowd, which now has money it can use to buy stocks.

•4. The "Self-Correcting Election." Colas sees the presidential race between President Obama and Mitt Romney as a win-win: If Romney wins, the market gets a market-friendly president; if Obama wins it's because the economy has recovered sufficiently to justify his re-election.

•3. China is OK, at worst. Despite the talk about a hard-landing, that would still entail 7.5 percent or so growth. Not bad.

•2. Lots of Bears. High levels of market sentiment in either direction are generally considered contrarian signals. The mass of doubters indicates that market still has room to rise.

And...the top reason for being bullish:

•1. "The end of the world only happens once - Monday probably isn't the day." Through recessions and depressions, flashes and crashes, we seem to persevere. "For all the well-publicized challenges facing markets and investors, financial Armageddon is still an unlikely occurrence," Colas writes. "And even if it does happen, what are the chances you really have enough gold coins, freeze-dried food and double-aught buckshot anyway?

Speculators find opportunity in swing trading as low valuation attracts buyers but market fear encourages profit taking. The conflicting factors, in addition of hot money, creates turbulence in equity stock market. The currency and commodities market are also affected as hot capital is looking for investment return. Bond market is safe heaven in short or long term aspect. Liquidity in capital market is tremendous but only small fraction is driving the real economy through lending to facilitate business operation.

Market should remain range bounded as market participants are still very cautious. After the strong rebound, many investors will realize profit and wait for another opportunity. Smart traders and market manipulators have already taken profit when market hovers near bottom. There is not yet sign of turning optimistic. There are still many uncertainties and coming news to drag down market. Overall participation in market activities remains low among household investors. Hedge funds are gradually accumulating stocks due to net inflow of capital and attractive market valuation.

Goldman Sees a 29% Return From Commodities Over 12 Months

Goldman Sachs Group Inc. said it expects a 29 percent return from the Standard & Poor's GSCI Enhanced Commodity Index over the next 12 months, with the biggest gains in energy and base metals.

Policymakers in Europe will be able to contain the continent's debt crisis, while recovery in the U.S. and China is set to continue, Jeffrey Currie, head of commodities research in New York, said today in a report. Returns on energy investments may be 41 percent in 12 months, compared with 23 percent in base metals and 18 percent in precious metals, while agriculture is forecast to lose 14 percent in the period, according to the report.

"Although the macroeconomic backdrop still remains uncertain, particularly in Europe, we believe that the sell-off in commodity prices is likely overdone and the price risks are shifting more to the upside," Currie wrote.

Bond Bubble Dismissed as Low Yields Echo Pimco's New Normal

Mohamed El-Erian knows why bond markets from the U.S. to Germany to Brazil, where yields have dropped to record lows even though debt has ballooned to more than $40 trillion worldwide, aren't a bubble waiting to burst.

The average yield on bonds issued by the Group of Seven nations has fallen to 1.120 percent from 3 percent in 2007, Bank of America Merrill Lynch index data show. Germany's two-year note yield fell below zero for the first time on June 1, while Switzerland's has been negative since April 24, meaning investors are paying for the right to lend the nation money.

Yields on government securities in the U.S., Germany, the U.K., Austria, the Netherlands, Finland and Australia tumbled to all-time lows this month as Europe's debt crisis intensified, manufacturing worldwide slowed and unemployment in the U.S. unexpectedly rose.

"You're not talking about a bubble because a bubble is about greed," Jeffrey Rosenberg, chief investment strategist for fixed income at BlackRock Inc. in New York, which has $3.68 trillion under management, said in a June 6 telephone interview. "That's not a reflection of ‘I expect prices to go higher and I have to jump in,' that's a reflection of ‘I want to preserve my principal.' Negative yields reflect fear."

Pimco officials point to Japan, which has been in and out of recession since the mid-1990s, as what the new normal would look like. Even though it has the world's largest debt load at more than $11 trillion, Japan has some of the world's lowest bond yields because of years of below-average growth.

"In many ways, we are replicating the Japanese experience," George Magnus, senior economic adviser in London at UBS AG, said in a June 5 telephone interview. "Banks and households have become overextended, and now we know governments have also become overextended. The problem is that the deleveraging means people are saving more. There is no sufficient spending and lending to boost the economy."

Central banks, including the Fed, ECB and Bank of Japan, have helped soak up the extra supply as policy makers injected money into their economies by purchasing government securities. The balance sheets of the world's six biggest central banks have more than doubled since 2006 to $13.2 trillion, according to Chicago-based Bianco Research LLC.

"Yields are extremely low for a very good reason, and that's fear," Stuart Thomson, a money manager at Ignis Asset Management in Glasgow, which oversees about $115 billion, said in an interview on June 1. "I don't see us heading into a bear market."

Citizenship for sale: Foreign investors flock to U.S.

Facebook co-founder Eduardo Saverin drew public ire last month following the revelation that he had renounced his U.S. citizenship, a move widely seen as a tax dodge. But thousands of wealthy foreigners are lining up to replace him, making investments here and putting themselves on a path to citizenship in the process.

The State Department expects to issue over 6,000 "investor visas" in the current fiscal year, which would be an all-time record. Other countries, meanwhile, are following the U.S.'s lead, keen to spur growth in lean economic times.

Under the government's EB-5 Immigrant Investor program, foreign investors can get conditional visas that allow them and their families to live, work and attend school in the U.S. To qualify for the visa, they must invest at least $1 million in a new or recently created business, or $500,000 for businesses in rural or high-unemployment areas.

Demand shows no sign of slowing down, either. International travel, banking and communication have become increasingly easy, while Asia, in particular, is minting new millionaires at a rapid pace.

Foreign holdings of US debt hit record high

Foreign demand for U.S. Treasury securities rose to a record high in April. China, the largest buyer of Treasury debt, increased its holdings slightly after trimming them for two straight months.

Demand for Treasury securities has remained strong despite the first-ever downgrade of the government's debt last August. Standard & Poor's lowered its rating on long-term Treasury debt one notch from AAA to AA+ following a prolonged debate in Congress over increasing the nation's borrowing limit.

Last week, S&P reaffirmed that rating and said it was keeping a negative outlook on the rating for the future.

Is High Frequency Trading Ruining the Market?

High-frequency trading (HFT) is a market-skewing, artificial form of speculation that places undo pressure on already fragile markets, which, by doing so, increases the risk of another flash crash or something much worse. HFT accounts for over 50% of all trading volumes, further distancing individual investors from the market and eliminating virtually any link between valuation and market price.

These trades are all based on picking up the next penny of a stock's move. The programs look for any indication of direction—be it order imbalance, momentum tells, or whatever else can be jammed into an algorithm—and jumps in front of the trade. The goal is to buy a few thousand shares ahead of a tiny move, and then sell when the move arrives. Repeat the process millions of times a year and it adds up to real profits for HFT firms.

The high-frequency trades run amok because there is no longer a market maker (read: human) in the middle of the trading process. The function of matching every buyer with a seller is fully automated, eliminating what Saluzzi calls a "shock absorber" for stocks. As a result, too many program trades can create vacuums where prices lurch beyond where they otherwise might be, as the HFT merrily picks off market orders made by actual people.

Contrarian Investing? Forget About It, Cramer Says

In the investment world, a contrarian is someone who takes a position that differs from the majority. If a particular sector is "hated" by most investors, a contrarian might want to buy in. After all, if few investors like the sector, a contrarian thinks there are few people left to sell, making it immune to big declines.

Cramer noted many industrial managers said things were weaker than people thought thanks to fears over Europe's ongoing debt crisis, which means they didn't meet their earnings estimates. Upon hearing this, the few investors who owned industrials sold their shares. The industrial stocks got hammered.

So even the contrarians think that Europe's economy is only getting worse and they couldn't take the pain, Cramer said, despite the fact they thought their contrarian trade would have been immunized against it.

It's Do or Die for U.S. Stocks

With major indexes rallying back to important short-term price ceilings, the stage is set for what may become the stock market's biggest collective decision of the summer.

Whether it is confirmation by Fed Chairman Ben Bernanke that he will print more money or the pending elections in Greece, the news should spark a technical breakout or breakdown, respectively.

10 Reasons to Be a Bull, From a Stock Market Bear

Finding reasons not to like the current stock market doesn't take much work, as the faltering U.S. economy, European debt crisis and looming fiscal cliff makes the job pretty easy.

But devising a list to be bullish - after one dismisses the usual "stocks are cheap" and "best house in a bad neighborhood" platitudes - takes some work, especially if your natural inclination is that the market is heading lower.

The list:

•10. Corporations are managing risk and doing more with less. Yes, a form of the "stocks are cheap" argument, but with acknowledgement that a pullback in earnings would still leave companies in solid shape profit-wise.

•9. Consumer confidence is still high. Friday's numbers indicated that consumer sentiment is beginning to wane, but remains strong.

•8. Gas prices are trending lower. Sure, $3.52 a gallon is still high, but it's 20 cents lower than last month.

•7. Forget Facebook, the capital markets are still open "if highly selective." The social network's initial public offering was a flop, but other deals, including Thursday's Felda Global Ventures $3.1 billion IPO, are raising cash.

•6. Mortgage rates still falling. Home borrowing rates at record lows are dragging the industry off its bottom.

•5. Mom-and-pop investors are making money, but with bonds. While we've been bemoaning all those fund flows out of equities and into fixed income, it's worked out well for the retail crowd, which now has money it can use to buy stocks.

•4. The "Self-Correcting Election." Colas sees the presidential race between President Obama and Mitt Romney as a win-win: If Romney wins, the market gets a market-friendly president; if Obama wins it's because the economy has recovered sufficiently to justify his re-election.

•3. China is OK, at worst. Despite the talk about a hard-landing, that would still entail 7.5 percent or so growth. Not bad.

•2. Lots of Bears. High levels of market sentiment in either direction are generally considered contrarian signals. The mass of doubters indicates that market still has room to rise.

And...the top reason for being bullish:

•1. "The end of the world only happens once - Monday probably isn't the day." Through recessions and depressions, flashes and crashes, we seem to persevere. "For all the well-publicized challenges facing markets and investors, financial Armageddon is still an unlikely occurrence," Colas writes. "And even if it does happen, what are the chances you really have enough gold coins, freeze-dried food and double-aught buckshot anyway?

Tuesday, June 12, 2012

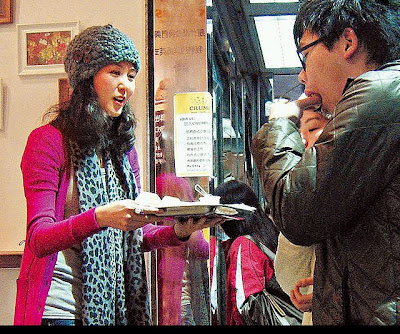

送完波餅送上樓 袁彌明吼中政黨主席 (原載《忽然一周》)

由全城注目的「狼豬大戰」,到創新高 18萬人參與六四燭光晚會,港人的政治意識愈來愈強。而一向大膽敢言的落選港姐袁彌明,由商界跳入政界,去年加入政黨「人民力量」,更揚言積極考慮參選區議會。

區議員席位尚未到手,一向野心大的袁彌明已有新目標,吼中「人民力量」的主席劉嘉鴻。周日( 3日),本刊拍得二人在銅鑼灣繑手行街。袁替男方選購恤衫時,更大方從後胸壓對方,之後二人又孖住返男方屋企,關係不言而喻。提到這樁政壇新戀情,袁彌明發揮政治智慧說:「另一半最緊要政治理念一致,但即使拍拖都唔會減低我從政嘅決心。」

銳意從政的袁彌明近日頻頻現身政治活動,一時到立法會門外靜坐撐拉布,一時又走到旺角街頭拉橫額促請政府發免費電視牌照,更經常落區與市民打好關係。不過袁彌明為市民謀福利的同時,亦順手幫自己爭取幸福。

體貼度身

袁彌明與劉嘉鴻到位於銅鑼灣的英國品牌「 Jack Wills」買恤衫。袁拿起一件紫色恤衫後,第一時間便放在劉身上度身。

主動埋單

袁彌明為冧劉嘉鴻,更主動送贈這件$750元的恤衫俾男方。

親密繑手

二人買完衫後齊齊行街,其間袁彌明更情不自禁地挽著劉嘉鴻手臂,而劉亦十分受落。

齊齊返歸

劉嘉鴻之後帶袁彌明返回男方位於銅鑼灣的寓所,二人密會一小時後才落樓。

拉布傳情

據知,「人民力量」黨成員之一的袁彌明,近月與黨主席劉嘉鴻過從甚密,有不少黨員就指二人經常留守黨總部開會傾通宵,之後更孖住齊齊走。知情人士說:「佢哋傾到好夜至走,第二日又會約埋一齊返總部開會。佢哋好夾,劉主席未出聲 Erica(袁之洋名)已經知道佢需要啲乜。」上月的立法會拉布戰,有人就目睹劉嘉鴻對袁彌明關懷備至,態度儼如一對情侶,「成班黨員之前發起喺立法會門外聲援拉布,喺休息期間,劉主席主動除件西裝褸俾 Erica當被冚。」

近日袁彌明和劉嘉鴻經常孖咇上陣宣傳政綱。周日( 3日)兩人除在柴灣搞牙科保健講座外,周一( 4日)更聯同黃毓民到銅鑼灣街頭嗌咪為六四平反(右圖)。

「人民力量」上月中舉行「拉布抗惡法」集會,劉嘉鴻(左二)和袁彌明亦有份出席,二人之後更於立法會外抗議超過六小時。《蘋果日報》圖片

街頭繑手

袁彌明周日( 3日)下午要拍住劉嘉鴻到柴灣宣傳政綱,不過開工前,二人便先相約在銅鑼灣拍拖,第一站就去買男裝。記者發現袁彌明十分細心,為劉嘉鴻挑選合身恤衫時,經常幫他整理衫袖和衫領,十足女友咁款。記者當時聽到她溫柔地說:「都話你要揀中碼至啱㗎啦!再改短埋個袖就 fit曬!你鍾意嘅話,我送俾你啦!」趁男方換衫時,袁立即去收銀處俾錢。二人買完衫再漫步銅鑼灣街頭,此時袁熱情地挽著男方手臂。袁送衫之餘,亦送埋上門,與劉嘉鴻齊齊返回男方位於銅鑼灣的寓所。大概一小時後,二人齊齊落樓,出發到柴灣開工。

袁:佢對我好重要

周二( 5日),記者致電袁彌明,她直認對劉嘉鴻有好感:「我有機會參選區議員,佢(劉嘉鴻)呢幾個月對我好重要。佢係一個好有才華嘅男人,我的確好仰慕佢。不過即使拍拖都唔會減低我從政嘅決心。」而劉嘉鴻則說:「我哋嘅政治理念相似,大家傾得埋,佢亦係一個細心、工作有衝勁嘅女仔。(拍拖幾耐?)依家想專注番事業先,其他嘢之後再講啦!」

多情才女

前度《蘋果日報》圖片

今年 31歲的袁彌明, 05年參選港姐,兩年後和無綫決裂,正式轉型搞美容和飲食生意。近年袁彌明亦不時帶埋另一半出席電影首映,可惜兩段感情最終沒結果。

兩度情傷

袁彌明只做過兩年全職藝人,圈中緋聞男友只有崔建邦。袁從商後更和一名金融才俊撻著,當時她更帶埋男友撐自己新舖開張(圖),但甜蜜兩年後竟告分手收場。去年中,袁就帶新男友現身首映,更暗示有結婚打算,可惜一直冇下文。

轉向從商

袁退出娛圈後先冒險搞美容產品水貨生意,再開埋樓上舖賺第一桶金,之後她愈搞愈大,與胞姊夾份開乳酪店(圖)。沾手政治後,袁仍繼續管理三間美容產品樓上舖,而乳酪生意則交由胞姊打理。

政壇新星起底

今年 36歲的劉嘉鴻,外形並不出眾,身高只有五呎六,體形略胖。不過劉學歷不錯,中文大學畢業的他,平時喜歡周遊列國兼聽古典音樂。劉嘉鴻去年出任「人民力量」主席,曾出戰大坑選區區議員,最終以大比數敗給新民黨。為了專心從政,他年初索性放棄年薪過百萬的基金精算師一職。

區議員席位尚未到手,一向野心大的袁彌明已有新目標,吼中「人民力量」的主席劉嘉鴻。周日( 3日),本刊拍得二人在銅鑼灣繑手行街。袁替男方選購恤衫時,更大方從後胸壓對方,之後二人又孖住返男方屋企,關係不言而喻。提到這樁政壇新戀情,袁彌明發揮政治智慧說:「另一半最緊要政治理念一致,但即使拍拖都唔會減低我從政嘅決心。」

銳意從政的袁彌明近日頻頻現身政治活動,一時到立法會門外靜坐撐拉布,一時又走到旺角街頭拉橫額促請政府發免費電視牌照,更經常落區與市民打好關係。不過袁彌明為市民謀福利的同時,亦順手幫自己爭取幸福。

體貼度身

袁彌明與劉嘉鴻到位於銅鑼灣的英國品牌「 Jack Wills」買恤衫。袁拿起一件紫色恤衫後,第一時間便放在劉身上度身。

主動埋單

袁彌明為冧劉嘉鴻,更主動送贈這件$750元的恤衫俾男方。

親密繑手

二人買完衫後齊齊行街,其間袁彌明更情不自禁地挽著劉嘉鴻手臂,而劉亦十分受落。

齊齊返歸

劉嘉鴻之後帶袁彌明返回男方位於銅鑼灣的寓所,二人密會一小時後才落樓。

拉布傳情

據知,「人民力量」黨成員之一的袁彌明,近月與黨主席劉嘉鴻過從甚密,有不少黨員就指二人經常留守黨總部開會傾通宵,之後更孖住齊齊走。知情人士說:「佢哋傾到好夜至走,第二日又會約埋一齊返總部開會。佢哋好夾,劉主席未出聲 Erica(袁之洋名)已經知道佢需要啲乜。」上月的立法會拉布戰,有人就目睹劉嘉鴻對袁彌明關懷備至,態度儼如一對情侶,「成班黨員之前發起喺立法會門外聲援拉布,喺休息期間,劉主席主動除件西裝褸俾 Erica當被冚。」

近日袁彌明和劉嘉鴻經常孖咇上陣宣傳政綱。周日( 3日)兩人除在柴灣搞牙科保健講座外,周一( 4日)更聯同黃毓民到銅鑼灣街頭嗌咪為六四平反(右圖)。

「人民力量」上月中舉行「拉布抗惡法」集會,劉嘉鴻(左二)和袁彌明亦有份出席,二人之後更於立法會外抗議超過六小時。《蘋果日報》圖片

街頭繑手

袁彌明周日( 3日)下午要拍住劉嘉鴻到柴灣宣傳政綱,不過開工前,二人便先相約在銅鑼灣拍拖,第一站就去買男裝。記者發現袁彌明十分細心,為劉嘉鴻挑選合身恤衫時,經常幫他整理衫袖和衫領,十足女友咁款。記者當時聽到她溫柔地說:「都話你要揀中碼至啱㗎啦!再改短埋個袖就 fit曬!你鍾意嘅話,我送俾你啦!」趁男方換衫時,袁立即去收銀處俾錢。二人買完衫再漫步銅鑼灣街頭,此時袁熱情地挽著男方手臂。袁送衫之餘,亦送埋上門,與劉嘉鴻齊齊返回男方位於銅鑼灣的寓所。大概一小時後,二人齊齊落樓,出發到柴灣開工。

袁:佢對我好重要

周二( 5日),記者致電袁彌明,她直認對劉嘉鴻有好感:「我有機會參選區議員,佢(劉嘉鴻)呢幾個月對我好重要。佢係一個好有才華嘅男人,我的確好仰慕佢。不過即使拍拖都唔會減低我從政嘅決心。」而劉嘉鴻則說:「我哋嘅政治理念相似,大家傾得埋,佢亦係一個細心、工作有衝勁嘅女仔。(拍拖幾耐?)依家想專注番事業先,其他嘢之後再講啦!」

多情才女

前度《蘋果日報》圖片

今年 31歲的袁彌明, 05年參選港姐,兩年後和無綫決裂,正式轉型搞美容和飲食生意。近年袁彌明亦不時帶埋另一半出席電影首映,可惜兩段感情最終沒結果。

兩度情傷

袁彌明只做過兩年全職藝人,圈中緋聞男友只有崔建邦。袁從商後更和一名金融才俊撻著,當時她更帶埋男友撐自己新舖開張(圖),但甜蜜兩年後竟告分手收場。去年中,袁就帶新男友現身首映,更暗示有結婚打算,可惜一直冇下文。

轉向從商

袁退出娛圈後先冒險搞美容產品水貨生意,再開埋樓上舖賺第一桶金,之後她愈搞愈大,與胞姊夾份開乳酪店(圖)。沾手政治後,袁仍繼續管理三間美容產品樓上舖,而乳酪生意則交由胞姊打理。

政壇新星起底

今年 36歲的劉嘉鴻,外形並不出眾,身高只有五呎六,體形略胖。不過劉學歷不錯,中文大學畢業的他,平時喜歡周遊列國兼聽古典音樂。劉嘉鴻去年出任「人民力量」主席,曾出戰大坑選區區議員,最終以大比數敗給新民黨。為了專心從政,他年初索性放棄年薪過百萬的基金精算師一職。

胞兄親證真癲 龍心歐洲衰強姦 (原載《FACE 東周刊》)

佢住咗兩個月精神科!真實對白

「維園霆鋒」龍心(真名林克霖),雖然行為怪雞神化,但因生得似謝霆鋒,加上講 嘢啜核,即成網絡紅人。唔知真癲定假傻 嘅龍心,最近因衰手多惹禍,先在今月 2日在香港人網節目《星期 5冇女 2》涉非禮中泰混血模仙樂都(吳堯堯)、再被有線《怪談》主持岑寶兒(阿夢)踢爆,有人在維園六四燭光晚會公然自瀆,龍心變女性公敵。

隨時惹官非的龍心,原來早年在保加利亞亦因涉及風化案件而入獄,他在 YouTube影片上稱被屈強姦兼遭囚犯毆打。上週六( 9日),龍心胞兄向本刊剖白弟弟病發情況,更無奈表示:「我 哋都想佢俾人醫。」

35歲、言行古怪的龍心於今年 4月在《城市論壇》自稱美國黑社會「福青幫」成員而「成名」,有指他擁碩士學歷兼曾在南非從事 IT工作,但有傳他因甩拖兼入獄而搞到精神有問題,身世超離奇。

上月底,在北角經營玉器店嘅林生被胞弟龍心上門拍片滋擾,最後被迫報警,他說:「當時有客人,你又講粗口又拍曬片,我冇得容忍。」

阿爸避走

今年初,龍心甫回港即大鬧機場,更以粗口辱罵有份接機嘅林父,胞兄解釋:「爸爸自細管教我哋好嚴,可能佢(龍心)唔鍾意先會喺病發時亂講嘢。」

喜愛夜蒲

自稱曾在 36個國家流浪 5年嘅龍心(左),在《星期 5冇女 2》中透露自己經常溝鬼妹,更在保加利亞撩鬼妹打野戰。

龍心喜歡拍短片放上網,未癲前其實算好樣。「龍心前傳之克林大帝於盧旺達及保加利亞的悲痛經歷」一片更講述自己獄中遭遇。

今月 2日龍心被邀上人網節目《星期 5冇女 2》做嘉賓,多次出言挑逗兼對仙樂都鬱手鬱腳,事後仙樂都報案被非禮,龍心反指女方博出位。之後又發生六四自瀆事件,兩位受害者都聲稱已經報警。

Monday, June 11, 2012

Sunday, June 10, 2012

Space tourists can hop on a flight in 2014, XCOR says

By Denise Chow

Thrill seekers looking for the ultimate rocket ride may soon turn that dream into a reality aboard a new suborbital spaceship, a winged rocket plane slated to start launching space tourists from California and a tiny Caribbean island by 2014.

The Mojave, Calif.-based XCOR Aerospace is developing the suborbital Lynx space plane to carry paying passengers to the upper reaches of the atmosphere, to altitudes up to and exceeding 62 miles (100 kilometers). XCOR is aiming to begin operational Lynx flights from California's Mojave Spaceport in 2013 and from the Dutch-controlled island of Curacao in the Caribbean a year later, said Andrew Nelson, XCOR's chief operating officer.

XCOR officials unveiled their launch targets Thursday during a news briefing here to announce a new partnership with Space Expedition Corp. (SXC, formerly Space Expedition Curacao), a Netherlands-based space tourism firm that will now act as the sales agent for future Lynx flights. The swanky event was held at the Park Avenue Armory, where artist Tom Sachs is currently showcasing his "Space Program: Mars" art installation on Manhattan's Upper East Side.

As part of the agreement, SXC will be responsible for selling seats aboard the Lynx space plane for flights departing from Mojave and from the picturesque island of Curacao, a territory that remains under the Kingdom of the Netherlands.

"Today, we are at the dawn of a new space age," Nelson told an audience that included officials from Curacao and the Mojave Spaceport, and Michael Lopez-Alegria, a former NASA astronaut and the current president of the Commercial Spaceflight Federation. "The old ways of government-designed space exploration are slowly drifting away, and a new commercial space industry is being born right before you."

XCOR's two-seat Lynx space plane is designed to carry one pilot and one passenger, making it an intimate and extremely personal journey, he added. The reusable vehicle will be capable of flying up to four flights per day, and is able to take off and land on a conventional airport runway.

"Ladies and gentlemen, the saying 'the sky is the limit' is something of the past," said Abdul Nasser El Hakim, Curacao's minister of Economic Development. "In Curacao, we say 'the space is the limit.'"

Watchmaker Luminox also recently announced a partnership with SXC to provide special timepieces for the firm's space tourists. The watches are being developed to withstand the G-forces that will be encountered during the flight.

A ride aboard Lynx will retail at $95,000, company officials said, which includes the cost of pre-flight training sessions to prepare passengers for the experience. While this may seem like a steep ticket price, it is still cheaper than the company's competitors, such as Virgin Galactic's $200,000 price tag for a seat aboard its SpaceShipTwo suborbital rocket plane.

Virgin Galactic is expected to carry out a series of critical tests later this year and could begin flying paying customers by the end of 2013, company officials have said.

By providing lower cost suborbital flights, XCOR and SXC are hoping to make commercial spaceflight more accessible to the public, said Michiel Mol, CEO of Space Expedition Corp. XCOR and SXC together have taken more than 175 reservations from clients eager to launch aboard the Lynx spacecraft.

"It's becoming available to all," Nelson of XCOR said. "Space, in a certain era, was something you saw and you were amazed (by), but perhaps you didn't feel like you were really going to be the one to participate in. But now, we can transfer ourselves into the faces and the names and the sights that we're seeing develop in front of us. I think it's going to revolutionize the way we view space, the way we approach space, the way we create new industries."

And as the development of commercial suborbital and orbital vehicles continues at an aggressive pace, the possibilities for this burgeoning private industry are limitless, said Rick Searfoss, a former NASA astronaut and space shuttle commander, and XCOR's chief test pilot.

"The world, in general, doesn't realize how quickly it will be upon us," Searfoss said. "We just don't know — we cannot imagine what this might lead to. Who knows where we might go, where we might be 20 to 30 years from now?"

Thrill seekers looking for the ultimate rocket ride may soon turn that dream into a reality aboard a new suborbital spaceship, a winged rocket plane slated to start launching space tourists from California and a tiny Caribbean island by 2014.

The Mojave, Calif.-based XCOR Aerospace is developing the suborbital Lynx space plane to carry paying passengers to the upper reaches of the atmosphere, to altitudes up to and exceeding 62 miles (100 kilometers). XCOR is aiming to begin operational Lynx flights from California's Mojave Spaceport in 2013 and from the Dutch-controlled island of Curacao in the Caribbean a year later, said Andrew Nelson, XCOR's chief operating officer.

XCOR officials unveiled their launch targets Thursday during a news briefing here to announce a new partnership with Space Expedition Corp. (SXC, formerly Space Expedition Curacao), a Netherlands-based space tourism firm that will now act as the sales agent for future Lynx flights. The swanky event was held at the Park Avenue Armory, where artist Tom Sachs is currently showcasing his "Space Program: Mars" art installation on Manhattan's Upper East Side.

As part of the agreement, SXC will be responsible for selling seats aboard the Lynx space plane for flights departing from Mojave and from the picturesque island of Curacao, a territory that remains under the Kingdom of the Netherlands.

"Today, we are at the dawn of a new space age," Nelson told an audience that included officials from Curacao and the Mojave Spaceport, and Michael Lopez-Alegria, a former NASA astronaut and the current president of the Commercial Spaceflight Federation. "The old ways of government-designed space exploration are slowly drifting away, and a new commercial space industry is being born right before you."

XCOR's two-seat Lynx space plane is designed to carry one pilot and one passenger, making it an intimate and extremely personal journey, he added. The reusable vehicle will be capable of flying up to four flights per day, and is able to take off and land on a conventional airport runway.

"Ladies and gentlemen, the saying 'the sky is the limit' is something of the past," said Abdul Nasser El Hakim, Curacao's minister of Economic Development. "In Curacao, we say 'the space is the limit.'"

Watchmaker Luminox also recently announced a partnership with SXC to provide special timepieces for the firm's space tourists. The watches are being developed to withstand the G-forces that will be encountered during the flight.

A ride aboard Lynx will retail at $95,000, company officials said, which includes the cost of pre-flight training sessions to prepare passengers for the experience. While this may seem like a steep ticket price, it is still cheaper than the company's competitors, such as Virgin Galactic's $200,000 price tag for a seat aboard its SpaceShipTwo suborbital rocket plane.

Virgin Galactic is expected to carry out a series of critical tests later this year and could begin flying paying customers by the end of 2013, company officials have said.

By providing lower cost suborbital flights, XCOR and SXC are hoping to make commercial spaceflight more accessible to the public, said Michiel Mol, CEO of Space Expedition Corp. XCOR and SXC together have taken more than 175 reservations from clients eager to launch aboard the Lynx spacecraft.

"It's becoming available to all," Nelson of XCOR said. "Space, in a certain era, was something you saw and you were amazed (by), but perhaps you didn't feel like you were really going to be the one to participate in. But now, we can transfer ourselves into the faces and the names and the sights that we're seeing develop in front of us. I think it's going to revolutionize the way we view space, the way we approach space, the way we create new industries."

And as the development of commercial suborbital and orbital vehicles continues at an aggressive pace, the possibilities for this burgeoning private industry are limitless, said Rick Searfoss, a former NASA astronaut and space shuttle commander, and XCOR's chief test pilot.

"The world, in general, doesn't realize how quickly it will be upon us," Searfoss said. "We just don't know — we cannot imagine what this might lead to. Who knows where we might go, where we might be 20 to 30 years from now?"

Friday, June 8, 2012

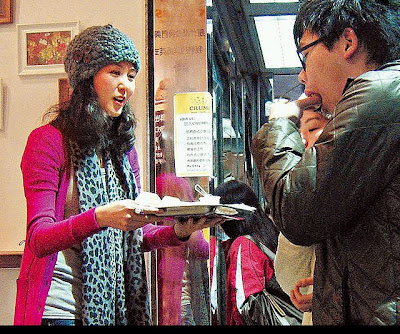

不滿新戲飛紙仔 Sammi 借病玩謝杜琪峯 (原載《忽然1週》)

鄭秀文、劉德華與杜琪峯合作的新戲《盲探》,早於去年尾開拍,但遲遲未有完整劇本,「飛紙仔」情況相當嚴重,令劇中男女主角劉華及 Sammi,怨聲載道。

據知 Sammi曾因「飛紙仔」問題,與杜 Sir吵過幾次。至於劉華,一早已訂下五、六月陪產及湊 B大計,見新片埋尾無期,即私下與 Sammi夾計。 Sammi為了老友,不惜做醜人,向杜琪峯攞一個月病假,理由係耳水不平衡要休息。

《盲探》原本計劃 8月完工,杜 Sir面對超支好頭痕,但自己唔著在先,局住冇聲出。

超支都因為你!(設計對白)《蘋果日報》圖片

鄭秀文、劉德華與杜琪峯的鐵三角組合,包括《孤男寡女》、《瘦身男女》及《龍鳳鬥》,全部大收旺場。本應合作無間的三人,最近卻因為新戲《盲探》而鬧不快。

其實《盲探》早於去年已開拍,但因杜琪峯同時要飛去天津兼拍《毒戰》,搞到《盲探》遲遲未有完整劇本。杜琪峯更多次在現場突然改劇本,令《盲探》飛紙仔情況相當嚴重,至今都未拍好一半。今年初,知道自己將為人父的劉華,為怕《盲探》延誤,打亂他的湊 B大計,已經開始催杜琪峯交劇本。

有工作人員爆料:「拍《盲探》時,劉華一有空檔就打俾老婆,收工就即刻趕返屋企,錫老婆錫到 燶。試過有一日進度特別慢,劉華終於忍唔住,同杜 Sir講:『要快 啲搞掂喇,我怕之後真係好難俾期你。』」

杜琪峯為免兩頭唔到岸,去年 12月決定先趕起《毒戰》,之後才拍《盲探》。《毒戰》最終在四月底完成,而《盲探》就緊接 5月底復工,對剛為人父的劉華來說,本來相當及時。豈料《盲探》仍然未有完整劇本,搞到 Sammi同劉華兩位主角火都滾埋。

劉德華是愛妻號,在產前產後對老婆朱麗倩都照顧有加,自然想多些時間親近初生女兒。《蘋果日報》圖片

工作人員透露:「上年開拍時,因為跳拍及劇本多改動, Sammi同劉華好多時去到現場都唔係好知自己拍乜。試過有一場戲講 Sammi開槍打中劉華,但杜 Sir拍 嘅時候仲未度好場戲 嘅上文下理,只係講 咗句『我覺得咁樣好睇 噃!拍 咗先啦!』兩位阿哥阿姐惟有你眼望我眼。 Sammi開始有 啲脾氣,同杜 Sir呻話唔知場戲要俾咩表情,亦因為飛紙仔, Sammi已經三番四次出聲以示不滿。」

雖然未有完整劇本,但杜琪峯堅持五月尾開工,拍住 嚟改。可是近日 Sammi以耳水不平衡為由請咗個多月長假休息,《盲探》的拍攝進度於是一拖再拖。「 Sammi同劉華私底下溝通過,兩人都認為搞好曬個劇本至開工比較有效率。 Sammi亦好體諒劉華想多 啲陪妻女 嘅心情。其實 Sammi耳水不平衡 嘅情況唔算好嚴重,不過佢一心為老友爭取『產假』,於是咪將病情誇張,等劉華放多半個月。」

養病期間的 Sammi,清晨及晚上仍活躍上微博及 facebook,看來本月下旬《盲探》應該有望復工,不過預期在 8月完工就有點困難。

本刊致電投資拍《盲探》的寰亞電影及東亞娛樂的發言人梁小姐,她說:「係 Sammi親自向杜 Sir攞病假,我 哋都希望 Sammi可以休息一個月。(咁 8月埋唔到尾 噃!)公司會體諒,因為咁而超支都冇所謂。(一拖再拖係咪因為未有完整劇本?)其實一早有完整劇本,只不過杜 Sir精益求精,飛紙仔係佢 嘅習慣 嚟 啫!但以佢哋三個嘅關係,飛紙仔係冇問題。」至於杜 Sir電話未有人接聽。

有電影公司撐腰, Sammi為劉華甘做醜人兼得罪杜琪峯,都可以大事化小啦!

《孤男寡女》收得,造就了劉德華及 Sammi這一對銀幕情侶,兩人亦私交甚篤,乜都有偈傾。之後兩人拍杜琪峯執導的兩套電影亦大收,三部片香港票房合共收近一億元,成為票房神話。

00年《孤男寡女》 3500萬

01年《瘦身男女》 4000萬

04年《龍鳳鬥》 1500萬

6月 2日深夜,鄭秀文自稱因為不適而睡不著,但由 3日淩晨三時起,她就一連發了六個微博,最後一個更是早上十時發出。看來她雖然抱恙,但仍很有精力。

冧杜 Sir補鑊

鄭秀文都知衰,她見杜琪峯的《奪命金》包攬了大陸華語電影傳媒大獎的最佳導演、最佳男主角及最佳女配角,於是在微博上 like爆,又轉載了杜琪峯的得獎照片。

面書賣口乖

雖然病咗, Sammi都有更新 facebook向 fans報病情及多謝電影公司體諒。但從她的新相片看來,她不是太病啫!

《盲探》似《神探阿蒙》

《盲探》講述偵探劉華在一次行動中視網膜脫落導致失明,因此被迫提前退休。他從一次銀行搶劫案中認識了女警員鄭秀文,鄭秀文發覺劉德華的聽覺與嗅覺非常敏銳,就請求劉華幫助她破案。劉華劇中為人麻煩,又多怪癖,和著名美劇《神探阿蒙》( Monk)的男主角十分相似。

劉德華在《盲探》首次扮盲人,盲住 chok都難唔到佢

劉德華盲都有動作場面,仲可以射中對手,唔怪得連受傷 嘅 Sammi都大讚。

據知 Sammi曾因「飛紙仔」問題,與杜 Sir吵過幾次。至於劉華,一早已訂下五、六月陪產及湊 B大計,見新片埋尾無期,即私下與 Sammi夾計。 Sammi為了老友,不惜做醜人,向杜琪峯攞一個月病假,理由係耳水不平衡要休息。

《盲探》原本計劃 8月完工,杜 Sir面對超支好頭痕,但自己唔著在先,局住冇聲出。

超支都因為你!(設計對白)《蘋果日報》圖片

鄭秀文、劉德華與杜琪峯的鐵三角組合,包括《孤男寡女》、《瘦身男女》及《龍鳳鬥》,全部大收旺場。本應合作無間的三人,最近卻因為新戲《盲探》而鬧不快。

其實《盲探》早於去年已開拍,但因杜琪峯同時要飛去天津兼拍《毒戰》,搞到《盲探》遲遲未有完整劇本。杜琪峯更多次在現場突然改劇本,令《盲探》飛紙仔情況相當嚴重,至今都未拍好一半。今年初,知道自己將為人父的劉華,為怕《盲探》延誤,打亂他的湊 B大計,已經開始催杜琪峯交劇本。

有工作人員爆料:「拍《盲探》時,劉華一有空檔就打俾老婆,收工就即刻趕返屋企,錫老婆錫到 燶。試過有一日進度特別慢,劉華終於忍唔住,同杜 Sir講:『要快 啲搞掂喇,我怕之後真係好難俾期你。』」

杜琪峯為免兩頭唔到岸,去年 12月決定先趕起《毒戰》,之後才拍《盲探》。《毒戰》最終在四月底完成,而《盲探》就緊接 5月底復工,對剛為人父的劉華來說,本來相當及時。豈料《盲探》仍然未有完整劇本,搞到 Sammi同劉華兩位主角火都滾埋。

劉德華是愛妻號,在產前產後對老婆朱麗倩都照顧有加,自然想多些時間親近初生女兒。《蘋果日報》圖片

工作人員透露:「上年開拍時,因為跳拍及劇本多改動, Sammi同劉華好多時去到現場都唔係好知自己拍乜。試過有一場戲講 Sammi開槍打中劉華,但杜 Sir拍 嘅時候仲未度好場戲 嘅上文下理,只係講 咗句『我覺得咁樣好睇 噃!拍 咗先啦!』兩位阿哥阿姐惟有你眼望我眼。 Sammi開始有 啲脾氣,同杜 Sir呻話唔知場戲要俾咩表情,亦因為飛紙仔, Sammi已經三番四次出聲以示不滿。」

雖然未有完整劇本,但杜琪峯堅持五月尾開工,拍住 嚟改。可是近日 Sammi以耳水不平衡為由請咗個多月長假休息,《盲探》的拍攝進度於是一拖再拖。「 Sammi同劉華私底下溝通過,兩人都認為搞好曬個劇本至開工比較有效率。 Sammi亦好體諒劉華想多 啲陪妻女 嘅心情。其實 Sammi耳水不平衡 嘅情況唔算好嚴重,不過佢一心為老友爭取『產假』,於是咪將病情誇張,等劉華放多半個月。」

養病期間的 Sammi,清晨及晚上仍活躍上微博及 facebook,看來本月下旬《盲探》應該有望復工,不過預期在 8月完工就有點困難。

本刊致電投資拍《盲探》的寰亞電影及東亞娛樂的發言人梁小姐,她說:「係 Sammi親自向杜 Sir攞病假,我 哋都希望 Sammi可以休息一個月。(咁 8月埋唔到尾 噃!)公司會體諒,因為咁而超支都冇所謂。(一拖再拖係咪因為未有完整劇本?)其實一早有完整劇本,只不過杜 Sir精益求精,飛紙仔係佢 嘅習慣 嚟 啫!但以佢哋三個嘅關係,飛紙仔係冇問題。」至於杜 Sir電話未有人接聽。

有電影公司撐腰, Sammi為劉華甘做醜人兼得罪杜琪峯,都可以大事化小啦!

《孤男寡女》收得,造就了劉德華及 Sammi這一對銀幕情侶,兩人亦私交甚篤,乜都有偈傾。之後兩人拍杜琪峯執導的兩套電影亦大收,三部片香港票房合共收近一億元,成為票房神話。

00年《孤男寡女》 3500萬

01年《瘦身男女》 4000萬

04年《龍鳳鬥》 1500萬

6月 2日深夜,鄭秀文自稱因為不適而睡不著,但由 3日淩晨三時起,她就一連發了六個微博,最後一個更是早上十時發出。看來她雖然抱恙,但仍很有精力。

冧杜 Sir補鑊

鄭秀文都知衰,她見杜琪峯的《奪命金》包攬了大陸華語電影傳媒大獎的最佳導演、最佳男主角及最佳女配角,於是在微博上 like爆,又轉載了杜琪峯的得獎照片。

面書賣口乖

雖然病咗, Sammi都有更新 facebook向 fans報病情及多謝電影公司體諒。但從她的新相片看來,她不是太病啫!

《盲探》似《神探阿蒙》

《盲探》講述偵探劉華在一次行動中視網膜脫落導致失明,因此被迫提前退休。他從一次銀行搶劫案中認識了女警員鄭秀文,鄭秀文發覺劉德華的聽覺與嗅覺非常敏銳,就請求劉華幫助她破案。劉華劇中為人麻煩,又多怪癖,和著名美劇《神探阿蒙》( Monk)的男主角十分相似。

劉德華在《盲探》首次扮盲人,盲住 chok都難唔到佢

劉德華盲都有動作場面,仲可以射中對手,唔怪得連受傷 嘅 Sammi都大讚。

Market Finds Support; Traders Retreat For The Moment

Equity stock market rebounds from bottom as expected in the last week. Investor confidence remains low but there is tremendous amount of capital in the market looking for opportunities. When market hits bottom, hot money flees to money market. Traders and market manipulators stop selling to beat down market and realize profit for the moment.

Although market appears to have support on bottom, there is not much buying from bargain hunters. Many market participants still prefer to hold cash on fear of a market collapse. The Euro zone crisis continues to weigh down market. Market participants are afraid that market manipulators will use the European sovereign debt crisis to drag down market. However the high cash level and low stock valuation discourages stock holders to dump shares for cash which provides mere return in a low interest rate environment.

Investors are still very cautious and hesitate to enter market despite sign of market stabilization. Investors confidence is low and market can be easily manipulated. The Euro zone crisis and US rating can be used as news by market manipulators to drive market to herd into fear.

When market fell in last year on US rating downgrade and European sovereign debt meltdown, some investors who sold early after market reached peak still made profit. However many investors who sold late after steep fall incurred significant loss. Fear of market meltdown created panic selling. Many investors suffered again after the 2008 financial crisis.

The same factors again come into existence lately. Learning from previous experience, market participants are pessimistic in market outlook. However, investors currently have the least percentage of holding in stocks since the financial meltdown in 2008 but with an increase of net worth from savings and wealth effect. Probability of panic selling is low unless market is shocked by unexpected catastrophe. Liquidity is ample due to Federal Reserve quantitative easing policy. Although the Euro zone crisis is worse than last year and Greece is close to default, traders and market manipulators are only selling selectively on bad news and do not aggressively short sell market as in last year when market participants herded into panic selling.